Gold. For centuries, it’s been a symbol of wealth, stability, and sometimes, mystery. Predicting where its price will go next feels like trying to guess the weather months in advance – tricky, complex, and full of surprises.

But what if we had a new kind of crystal ball, one powered by artificial intelligence? That’s happening right now. Understanding how AI predicts gold price trends is becoming essential for anyone watching the precious metals market.

Forget dusty charts alone; machines are learning to read the golden tea leaves, analyzing vast amounts of data faster than any human ever could. But how does it work, and can we trust it?

Key Takeaways on How AI Predicts Gold Price Trends

- AI Analyzes Massive Data: AI systems sift through historical prices, economic reports, news sentiment, and more to find patterns humans might miss.

- Multiple Factors Matter: AI considers inflation, central bank actions, interest rates, geopolitical events, and market sentiment.

- Different AI, Different Forecasts: Various AI models (like ChatGPT, Gemini, Claude) use unique algorithms and data, leading to a range of predictions.

- Economic Indicators are Crucial: AI heavily weighs factors like inflation expectations and monetary policy changes. Check out the key gold price factors AI considers.

- Central Bank Activity is Key: AI monitors large gold purchases by central banks, a significant driver of demand. Learn more about central bank gold purchases.

- Not a Perfect Crystal Ball: AI predictions offer insights but aren’t foolproof; they are tools, not guarantees, affected by unforeseen events and model limitations.

- Combines with Human Analysis: AI forecasts are often used alongside traditional analysis from financial institutions for a broader perspective.

What Makes Gold Prices Tick? The Old-Fashioned Way

Before we dive into the silicon brains, let’s quickly cover the basics. Why does the price of gold move up and down? It’s not just random. Several big forces are usually at play, acting like invisible hands pushing and pulling the market. Understanding these is step one, even before considering how AI predicts gold price trends.

Think of gold like a safe harbor in a storm. When people get nervous about the economy – maybe inflation is high, or there’s talk of a recession – they often buy gold. It’s seen as something solid, real, that holds its value when paper money might not. This makes it a popular safe-haven asset.

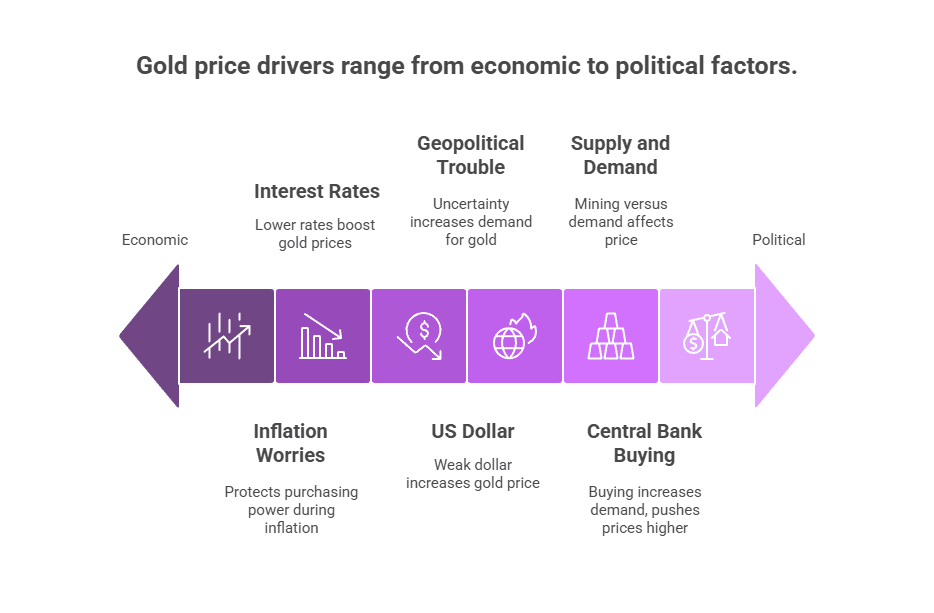

Here are some key drivers:

- Inflation Worries: When the cost of everything else goes up (inflation), gold often follows. People buy it hoping it will keep its purchasing power better than cash.

- Interest Rates: When central banks raise interest rates, holding gold becomes less attractive because gold doesn’t pay interest. You could earn interest holding cash or bonds instead. Lower rates often boost gold. The gold price after Fed meetings often reflects this.

- The US Dollar: Gold is usually priced in US dollars. When the dollar gets weaker compared to other currencies, it takes more dollars to buy an ounce of gold, so the price goes up (and vice-versa).

- Geopolitical Trouble: Wars, political instability, major elections – these kinds of events create uncertainty. Uncertainty often sends investors running towards perceived safety, like gold.

- Central Bank Buying: Governments around the world hold gold in their reserves. When central banks start buying large amounts, it significantly increases demand and can push prices higher.

- Supply and Demand: Like anything, the amount of gold being mined versus the amount people and industries want to buy affects the price. This includes demand for jewelry and industrial uses, like in electronics.

These factors interact in complex ways. Sometimes, one factor is dominant; other times, several pull in different directions. It’s this complexity that makes simple prediction so hard.

Enter the Machines: What is AI Forecasting?

So, we know the usual suspects influencing gold prices. Now, imagine a super-smart assistant that can watch all these factors, 24/7, across the entire globe, and learn from history how they usually interact. That’s essentially what AI forecasting tries to do. It’s a core part of understanding how AI predicts gold price trends.

AI, or Artificial Intelligence, isn’t magic. It’s about using computer systems to perform tasks that normally require human intelligence. In finance, this often means using machine learning – where computers learn from data without being explicitly programmed for every single scenario.

Think of it like this:

- Feed the Beast: You give the AI tons of historical data: past gold prices, inflation rates over decades, interest rate changes, news articles, social media sentiment, trading volumes, even satellite imagery of mining operations.

- Find the Patterns: The AI algorithms sift through this mountain of information, looking for hidden correlations and patterns. It might notice, for example, that a certain combination of rising oil prices and specific political news headlines has historically preceded a jump in gold prices 80% of the time.

- Build a Model: Based on these patterns, the AI builds a predictive model. This is like its internal rulebook or map of how it thinks the gold market works.

- Make a Forecast: Using the current, real-time data flowing in, the AI applies its model to predict where gold prices might head next – tomorrow, next week, or even next year.

- Learn and Adapt: Crucially, the AI constantly compares its predictions to what actually happens. When it’s wrong, it adjusts its model, hopefully becoming more accurate over time. This continuous learning is key.

AI can process far more data points and complex relationships than any human analyst. It can spot subtle signals in market sentiment or correlations across seemingly unrelated global events. This ability to digest and interpret vast datasets is AI’s superpower in forecasting. For more on analyzing market movements, consider looking into gold technical analysis.

Buy Gold Online: The Smart and Secure Way

Discover the safest and most reliable strategies to buy gold online. Make informed investment decisions and secure your financial future today!

Learn MoreGolden Insights: Visualizing the World of Gold Investments

Gold Price Movement (Last 5 Years)

The trajectory of gold prices reveals patterns of stability and surges. Investors watch these movements to time their entry and exit points in the market.

Notice how prices respond to economic uncertainty – each peak corresponds to major global events that drove investors toward this safe haven asset.

Gold Demand by Sector

Jewelry accounts for nearly half of annual gold demand, while investment and central bank purchases make up the balance. This breakdown shows gold’s dual role as adornment and asset.

Industrial applications represent a small but vital segment, with gold’s conductivity making it invaluable for technology applications.

Top Gold Holding Countries

Nations maintain gold reserves as part of their wealth strategy. The United States leads substantially, with European nations following closely behind.

Emerging economies have been steadily increasing their reserves, signaling a shift in global trust dynamics away from purely currency-based systems.

Gold vs. Other Investments (10 Year ROI)

Comparing gold against stocks, bonds, and real estate reveals its performance as a store of value during turbulent economic periods.

While other assets may outperform in bull markets, gold maintains its defensive position, proving its worth when markets decline.

The AI Toolkit: Models Crunching the Gold Numbers

When we talk about how AI predicts gold price trends, we’re not talking about one single type of AI. Different tools use different methods, like chefs using various recipes. Some focus heavily on numbers, others try to understand the ‘mood’ of the market through text.

Here are some common approaches AI uses:

- Time Series Analysis: This is a classic technique. AI models look purely at the history of gold prices themselves, searching for repeating patterns, trends, and seasonal effects. Think of it as learning the rhythm of the price chart.

- Regression Models: These models try to establish mathematical relationships between gold prices and various economic indicators (like inflation, GDP growth, interest rates). The AI figures out how much, on average, a change in an indicator impacts the gold price.

- Machine Learning Algorithms: This is where things get more advanced.

- Neural Networks: Inspired by the human brain, these complex models can identify highly intricate, non-linear patterns in data. They are good at combining many different types of inputs.

- Support Vector Machines (SVM): These are good at classification tasks – deciding if the price is more likely to go up or down based on current conditions.

- Random Forests: These build many simple ‘decision trees’ and combine their predictions for a more robust forecast.

- Natural Language Processing (NLP): This branch of AI focuses on understanding human language. AI models scan news articles, financial reports, social media posts, and even political speeches to gauge market sentiment. Is the overall tone positive, negative, or neutral towards gold? This sentiment analysis becomes another input for the price prediction models.

- Sentiment Analysis: A specific application of NLP, this focuses purely on identifying the emotional tone in text data related to gold or influencing factors. High fear might signal a move towards safe havens.

AI tools often combine several of these techniques. For example, a sophisticated model might use regression to understand economic drivers, NLP to gauge sentiment, and a neural network to combine everything and learn complex interactions. The choice of model and the specific data fed into it heavily influence the resulting forecast. You can explore various gold indicators that these AI models might track.

AI vs. The Experts: Comparing Predictions for 2025

So, the AI models run their calculations, and the big banks have their analysts. Who’s predicting what for gold, especially looking towards the near future like 2025? It’s fascinating to see the overlap and the divergence. Understanding these different viewpoints is crucial when evaluating how AI predicts gold price trends.

The information provided shows a snapshot from early 2025. Several AI tools offered quarterly forecasts:

TABLE 1: AI Gold Price Forecasts for 2025 (Snapshot as of Early 2025)

| AI Tool | 2025 Quarterly Forecasts | Data Focus |

|---|

| ChatGPT-4 Turbo | Q1: $2,826–$3,038 Q2: $3,084–$3,315 Q3: $3,366–$3,617 Q4: $3,673–$3,947 | Broad Text & Data Analysis |

| Gemini | Q1: $2,500–$2,800 Q2: $2,400–$2,900 Q3: $2,300–$3,000 Q4: $2,200–$3,100 | Multimodal Data Integration |

| Perplexity | Q1: $2,550–$2,750 Q2: $2,600–$2,800 Q3: $2,650–$2,850 Q4: $2,700–$2,900 | Real-time Information Search |

| Meta AI | Q1: $1,830–$1,970 Q2: $1,900–$2,050 Q3: $1,950–$2,120 Q4: $2,000–$2,180 | Social Data & Trends |

| Claude AI | Q1: $2,580–$2,750 Q2: $2,650–$2,850 Q3: $2,700–$2,950 Q4: $2,750–$3,000 | Contextual Understanding |

Source: Adapted from provided information, potentially originating from sources like BullionVault AI analysis.

Notice the significant variation. ChatGPT-4 Turbo was extremely bullish, predicting prices nearing $4,000 by year-end. Meta AI, conversely, was far more conservative, staying below $2,200. Gemini showed a very wide potential range, perhaps reflecting higher uncertainty in its model.

Now, let’s compare this to forecasts from major financial institutions around the same time:

- Goldman Sachs: Raised forecast to $3,300, citing ETF inflows and central bank buying.

- Bank of America (BofA): Predicted $3,500.

- J.P. Morgan: Forecast around $3,000.

- UBS: Aimed for $2,900.

Interestingly, the major banks seemed to cluster more tightly in their predictions (mostly $2,900 – $3,500) than the AI tools did. Their forecasts aligned more closely with the bullish AI predictions from ChatGPT and Claude AI, rather than the conservative Meta AI or the wide-ranging Gemini.

Both AI and human analysts pointed towards continued strength, often citing similar reasons like central bank demand and inflation concerns, reinforcing gold’s role as a potential safe haven during recession. You can often find updated forecasts from institutions on financial news sites like CNBC Gold Prices or Reuters Commodities.

Why Do AI Gold Predictions Differ So Much?

Seeing the wide range of AI forecasts in the table above begs the question: If AI is so smart, why don’t all the models agree? Understanding this variability is key to realistically interpreting how AI predicts gold price trends. The differences don’t necessarily mean AI is unreliable, but rather highlight the complexity of the task and the nuances of AI development.

Several factors contribute to these differing outlooks:

- Different Algorithms: As mentioned, AI tools use various underlying models (neural networks, regression, etc.). Each model has strengths and weaknesses and might interpret the same data differently. It’s like giving the same ingredients to different chefs – you’ll get different dishes.

- Training Data Variations: The historical data used to ‘train’ the AI is crucial. One AI might be trained on data going back 50 years, another only 10. One might include obscure economic indicators or alternative data sources (like satellite imagery), while another sticks to traditional financial data. The quality, quantity, and type of data shape the AI’s “worldview.”

- Weighting of Factors: Even if they use similar data, AI models might assign different levels of importance (weights) to various factors. One AI might heavily prioritize interest rates, while another gives more weight to geopolitical news sentiment or central bank activity.

- Real-time Data Processing: How quickly and effectively an AI incorporates new, incoming data can influence its short-term predictions. Some models might react faster to breaking news than others.

- Model Assumptions and Biases: All models, whether human or AI-created, have underlying assumptions. These can sometimes reflect biases present in the historical data used for training. For example, if an AI is trained primarily on data from periods of stable growth, it might struggle to accurately predict outcomes during unprecedented crises.

- Proprietary Elements: Many commercial AI forecasting tools use proprietary algorithms and data sources they don’t fully disclose. This “black box” nature makes direct comparison difficult.

Think of it less like getting the single right answer, and more like consulting a panel of experts, each with their own specialty and perspective. The range of predictions itself can be informative, indicating the level of uncertainty or agreement within the AI “community.”

TABLE 2: Key Factors Influencing AI Gold Predictions & Potential Variability

| Factor | Data Sources Used by AI | Why AI Predictions Might Vary Based on This Factor | Related Concept |

|---|---|---|---|

| Economic Growth | GDP reports, manufacturing indices, employment data | Different models weigh GDP vs. employment differently; data revisions impact AI predictions. | Economic Indicators |

| Inflation | CPI, PPI, inflation expectation surveys, commodity prices | Models may focus on core vs. headline inflation; differing future expectations lead to varying predictions. | Inflation Hedge |

| Interest Rates | Central bank announcements, bond yields, futures markets | Varying predictions of future rate hikes/cuts; focus differences on real vs. nominal rates affect outcomes. | Monetary Policy |

| Currency Strength | Forex rates (especially USD Index), trade balances | Different forecasting models and the impact of non-USD gold prices can alter predictions. | Currency Value |

| Market Sentiment | News headlines, social media, VIX index, fund flows (ETFs) | NLP interpretation varies; quantifying sentiment is subjective and data feeds differ between models. | Investor Behavior |

| Geopolitical Risk | News analysis, political stability indices, conflict tracking | Difficulty quantifying event impact; models react differently to sudden shocks and evolving geopolitical contexts. | Geopolitical Tensions |

| Central Bank Action | Official reserve announcements, news reports, analyst comments | Predicting future buying is challenging; models weigh past behavior differently, affecting forecasts. | Reserve Diversification |

| Supply/Demand | Mining output data, jewelry demand reports, industrial usage | Data lags exist and forecasting future industrial or consumer demand is complex, leading to prediction variability. | Market Fundamentals |

Beyond the Hype: Limitations of AI in Gold Forecasting

While AI offers powerful new tools for analyzing the gold market, it’s crucial to maintain perspective. Believing AI has a perfect crystal ball is a mistake. Understanding the limitations is just as important as understanding how AI predicts gold price trends. These tools are aids, not oracles.

Here are some key limitations to keep in mind:

- “Black Swan” Events: AI learns from historical data. It struggles to predict unprecedented events – things that haven’t happened before or happen very rarely (like a global pandemic or a sudden, unexpected financial crisis). These “black swans” can dramatically shift markets in ways the AI couldn’t anticipate based on past patterns.

- Data Quality and Bias: The old saying “garbage in, garbage out” applies strongly to AI. If the data used to train the AI is flawed, incomplete, or biased, the predictions will reflect those flaws. Historical data might contain biases that the AI inadvertently learns and perpetuates.

- The “Black Box” Problem: With complex models like deep neural networks, it can sometimes be difficult even for the creators to understand exactly why the AI made a specific prediction. This lack of transparency can make it hard to trust the forecast, especially when it contradicts conventional wisdom.

- Overfitting: Sometimes, an AI model learns the training data too well, including its random noise and quirks. It becomes great at explaining the past but poor at predicting the future because it hasn’t learned the underlying general principles.

- Changing Market Dynamics: Markets evolve. Relationships between indicators can change over time (e.g., gold’s relationship with interest rates isn’t always constant). An AI trained on past dynamics might lag in adapting to fundamental shifts in market behavior. Market volatility can increase during such shifts.

- Sentiment is Fickle: While AI tries to measure market sentiment, human emotions and crowd psychology can be irrational and shift rapidly in ways that are hard to model consistently.

- Cost and Accessibility: Developing and running sophisticated AI prediction models requires significant computing power and expertise, which might not be accessible to all investors. Relying on readily available AI tools means accepting their inherent methodologies and potential limitations.

Therefore, using AI predictions requires critical thinking. It’s wise to consider them as one input among many, alongside traditional analysis, expert opinions (like those found on GoldSilver.com or InvestingHaven), and your own understanding of the market. Don’t blindly follow any single prediction, AI or otherwise.

My Experience Watching How AI Predicts Gold Price Trends

Dipping my toes into the world of how AI predicts gold price trends wasn’t about finding a magic money machine. Honestly, I was skeptical but curious. Could lines of code really anticipate the twists and turns of a market driven by everything from global politics to raw human fear and greed? I started tracking predictions from a couple of accessible AI tools alongside commentary from seasoned analysts and my own basic chart observations using resources like Kitco live charts.

What struck me first was the sheer confidence some AI forecasts presented, often giving precise percentage probabilities or narrow price ranges. It felt authoritative, almost seductive. In contrast, human analysts often spoke more in terms of scenarios, support/resistance levels, and influencing factors, hedging their bets with “if-then” statements.

Here’s what I learned through observation:

- Short-Term Noise: AI seemed quite adept at picking up on short-term momentum shifts, sometimes flagging potential daily or weekly moves based on technical patterns or sudden shifts in trading volumes that I might have missed. However, it was also frequently whipsawed by minor news events, leading to predictions that quickly reversed.

- The Big Picture: For longer-term trends (months or quarters), the AI predictions often aligned with the major themes identified by human experts – inflation concerns boosting gold, potential rate hikes acting as a headwind. The AI’s contribution here felt more like quantifying the potential impact of these known factors based on historical correlations.

- Divergence is Instructive: When different AI tools gave wildly different forecasts (like the 2025 examples), it was a flag. It usually signaled high uncertainty or that different models were weighing conflicting factors (e.g., strong inflation vs. expected aggressive rate hikes). Instead of picking one, the divergence itself became a data point suggesting caution.

- Sentiment Surprises: Sometimes, an AI focusing on NLP and sentiment analysis would flag a shift before it was obvious in price charts. A subtle change in the tone of financial news or social media chatter, picked up by the AI, occasionally preceded a larger move. This highlighted the value of AI in processing unstructured data.

- Need for Context: Relying solely on an AI price target was useless without understanding why the AI predicted it. Was it based on rising inflation expectations? A predicted dollar decline? Geopolitical flare-ups? Knowing the underlying drivers the AI weighted heavily was crucial for deciding if the forecast seemed plausible. Exploring resources like the World Gold Council’s market trends helped provide this context.

Ultimately, watching how AI predicts gold price trends became less about finding the ‘right’ prediction and more about using AI as a sophisticated data processor and pattern spotter. It could highlight potential scenarios or correlations I hadn’t considered, but it never replaced the need for critical thinking and understanding the fundamental forces at play in the gold market.

It’s a powerful assistant, not a replacement for judgment, especially when considering how to invest in gold.

Looking Ahead: The Future of AI and Gold Investing

The intersection of artificial intelligence and gold investing is still in its early days, but the trajectory is clear: AI will play an increasingly significant role. As technology advances and more data becomes available, how AI predicts gold price trends will likely become more sophisticated and integrated into investment strategies.

What might the future hold?

- More Granular Data: AI will likely incorporate even more diverse datasets – think satellite imagery tracking shipping movements, real-time supply chain data, anonymized consumer spending patterns, and even analysis of political discourse for subtle cues. This big data approach aims to capture influencing factors earlier and more accurately.

- Improved NLP and Sentiment Analysis: AI’s ability to understand nuance, sarcasm, and context in language will improve, leading to more reliable sentiment readings from news and social media, potentially capturing shifts in investor behavior faster.

- Explainable AI (XAI): Addressing the “black box” problem is a major focus. Future AI models may be better able to explain why they are making a certain prediction, showing the key factors and data points driving the forecast. This increases transparency and trust.

- AI-Powered Robo-Advisors: Expect more automated investment platforms using AI not just for predictions, but also for portfolio construction and risk management, potentially offering dynamic strategies that adjust gold allocations based on AI forecasts and risk assessments. This relates to broader trends in precious metal investments.

- Integration with Other Technologies: Combining AI with blockchain for secure data tracking or quantum computing (as explored in how gold is used in AI and quantum computing) for even faster processing could unlock new predictive capabilities, though this is further down the road.

- Personalized Insights: Future AI tools might offer forecasts tailored to an individual investor’s risk tolerance, existing portfolio, and investment goals, moving beyond generic market predictions.

However, the limitations will likely persist. Unpredictable global events will still occur, market dynamics will shift, and the inherent complexity of human behavior will always add an element of uncertainty.

AI will become a more powerful tool for analysis and probability assessment, but the human element of judgment, risk management, and understanding broader context will remain essential for successful gold investing.

The journey of watching how AI predicts gold price trends is one of continuous learning and adaptation for both the machines and the investors using them.

Trying to predict gold prices has always been part art, part science. Now, Artificial Intelligence is adding a powerful new dimension to the science part. Understanding how AI predicts gold price trends reveals a fascinating process: machines digesting vast amounts of data, identifying complex patterns, and generating forecasts based on everything from inflation numbers to the sentiment expressed in news headlines.

We’ve seen that different AI tools can produce varying forecasts, reflecting their unique algorithms and data inputs. While some AIs predicted soaring gold prices for 2025, others were more cautious, highlighting that AI is not a monolithic entity with a single answer. Comparing these AI forecasts with those from seasoned human analysts at major financial institutions provides a richer, more nuanced picture.

Crucially, AI is not infallible. It struggles with unforeseen events and relies heavily on the quality of its data. It’s a sophisticated tool, capable of uncovering insights hidden within market noise, but it’s not a crystal ball. Think of it as an incredibly knowledgeable, fast-working research assistant, not a guaranteed path to riches.

The future likely involves deeper integration of AI into investment analysis, offering more granular insights and potentially more personalized forecasts. But the need for human judgment, critical thinking, and an understanding of the fundamental drivers of the gold market will remain paramount.

Use AI predictions as one valuable input in your decision-making process, stay informed from multiple sources (MarketWatch Gold is another good resource), and remember that navigating the world of gold investing always requires diligence and a healthy dose of realism. The machines are learning, and so should we.

Frequently Asked Questions

How accurate are AI gold price predictions?

AI gold price prediction accuracy varies significantly. It's limited by data quality, model design, and the inherent unpredictability of markets. AI struggles with unprecedented events and rapidly changing dynamics. No AI prediction is guaranteed; treat them as probabilistic forecasts.

What data does AI use to predict gold prices?

AI uses a wide array of data, including historical prices, economic indicators (inflation, GDP), financial market data (interest rates, currency exchange rates), market sentiment data (news, social media), geopolitical data, and supply/demand data (mining, central banks).

Can I rely solely on AI for gold investment decisions?

No, relying solely on AI is not advisable. AI predictions are tools with limitations. Investment decisions should involve a holistic approach combining AI forecasts with fundamental analysis, technical analysis, expert opinions, and your own risk tolerance and goals. Diversification and risk management are crucial.

Which AI model gives the best gold price forecast?

There is no single “best” AI. Different models produce varying predictions based on unique algorithms and data. The "best" approach is often to consider forecasts from multiple AI sources and compare them with traditional analysis, rather than seeking one definitive answer.

How do geopolitical events affect AI gold predictions?

Geopolitical events significantly impact AI gold predictions because they influence market sentiment, risk aversion, and currency movements. AI models often use Natural Language Processing (NLP) to scan news for relevant keywords. While increased risk often prompts AI to predict higher prices, quantifying the exact impact and predicting sudden shocks is challenging for AI.