Did you know that gold’s market capitalization is approximately $18 trillion, making it one of the most valuable assets in the world1?

Yet, the way we trade this ancient commodity is undergoing a revolutionary transformation. The integration of blockchain technology is reshaping the gold trade, bringing unprecedented transparency, security, and efficiency to the process.

Tokenization is at the heart of this shift. By converting physical gold into digital tokens, investors can now access fractional ownership, making gold investment more accessible than ever. This blend of traditional asset value with modern innovation is creating new opportunities for both seasoned and novice investors.

With blockchain, every transaction is recorded on a secure, immutable ledger. This ensures transparency and reduces the risk of fraud. As the world embraces digital solutions, the gold trade is no exception. The combination of investment and technology is empowering individuals to take control of their financial futures.

This article will guide you through this digital revolution, highlighting the benefits and investor advantages of blockchain in the gold trade. Stay tuned to discover how this powerful technology is reshaping the industry.

Key Takeaways: How Blockchain is Changing Gold Trade

- Blockchain technology is revolutionizing the traditional gold trade.

- Tokenization allows for fractional ownership of gold, making it more accessible.

- Secure, transparent transactions are now possible with blockchain.

- Investors can benefit from the blend of ancient asset value and modern innovation.

- This digital shift is creating new opportunities for both seasoned and novice investors.

Introduction to Gold and Blockchain: Setting the Stage

Gold has been a cornerstone of wealth for centuries, but its trading methods are evolving. The traditional approach to gold trading involves physical exchanges, vault storage, and complex logistics. This method, while reliable, often limits accessibility and liquidity for the average investor2.

In contrast, blockchain technology is introducing a new era of digital finance. By leveraging secure, decentralized ledgers, blockchain is transforming how assets like gold are traded. This shift is not just about technology—it’s about creating opportunities for everyone to participate in the market3.

Overview of Traditional Gold Trading

Historically, gold trading has been dominated by physical exchanges. Investors would buy and sell physical gold, often stored in secure vaults. This method, while effective, comes with challenges. Storage costs, transportation risks, and limited liquidity have made it difficult for smaller investors to participate2.

For example, the daily trading volume in London for gold is about 6,000 tons, yet the LBMA bullion bank reserve holds only 100 tons2. This disparity highlights the inefficiencies of traditional methods. Despite these challenges, gold remains a trusted asset, valued for its stability and historical significance.

The Emergence of Blockchain in Finance

Blockchain technology is revolutionizing finance by introducing transparency and security. Unlike traditional methods, blockchain records every transaction on an immutable ledger. This ensures that all trades are traceable and fraud-resistant3.

Buy Gold Online: The Smart and Secure Way

Discover the safest and most reliable strategies to buy gold online. Make informed investment decisions and secure your financial future today!

Learn MoreOne of the most significant advancements is the tokenization of gold. By converting physical gold into digital tokens, investors can now own fractional shares of this precious metal. This innovation not only increases accessibility but also enhances liquidity, making gold trading more inclusive3.

| Aspect | Traditional Gold Trading | Blockchain-Driven Gold Trading |

|---|---|---|

| Accessibility | Limited to large investors | Open to all investors |

| Liquidity | Low due to physical constraints | High with digital tokens |

| Security | Relies on physical storage | Immutable blockchain ledger |

| Transparency | Limited traceability | Full transaction history |

As the world embraces digital solutions, the gold trade is no exception. Platforms offering gold-backed cryptocurrencies are bridging the gap between physical assets and digital innovation. This blend of tradition and technology is empowering investors to take control of their financial futures.

The Blockchain Gold Revolution: 6 Key Insights

1. Traditional vs Blockchain Gold Trading

The contrast couldn’t be sharper. Physical gold trading involves vaults, paperwork, and middlemen. Blockchain delivers instant settlement, 24/7 trading, and fractional ownership. The numbers speak for themselves.

London’s gold market trades 6,000 tons daily but holds just 100 tons in reserve. Blockchain solves this disparity through tokenization, creating liquid digital assets backed by physical gold.

2. Gold Tokenization Growth

Tokenized gold assets surged 6.6% recently, hitting $38.8 billion in market cap. That’s $2.5 billion added in just 24 hours. This isn’t just growth—it’s a fundamental shift in how we own gold.

Platforms like Tether Gold and PAX Gold are leading this charge. They’re not disrupting gold—they’re making it more accessible while maintaining its timeless value.

3. Investor Adoption Rates

New investors are flooding in. 35% of digital gold holders are first-time precious metals buyers. They’re drawn by lower barriers—no vault fees, no minimums, just pure exposure to gold’s stability.

The demographic shift tells the story. Millennials now represent 41% of tokenized gold investors, compared to just 12% in traditional gold markets.

4. Transaction Security Comparison

Fraud incidents in traditional gold trading average 2.3% annually. Blockchain solutions? Zero confirmed cases. Every gram is accounted for on an immutable ledger.

BlockAid’s recent $50 million funding round underscores the priority of security in this space. Their blockchain audits verify physical gold backing down to the serial number.

5. Global Gold Tokenization Leaders

Switzerland and Singapore dominate, but the trend is global. Europe accounts for 58% of tokenized gold, Asia 28%, with North America rapidly catching up.

This isn’t a niche phenomenon. LBMA-approved refiners now tokenize 15% of their annual production—a figure projected to reach 40% by 2026.

6. Investor Portfolio Allocation

Smart money is moving. Hedge funds now allocate 6.2% to tokenized gold versus 3.8% for physical. The liquidity advantage is undeniable—trade anytime, anywhere, in any increment.

Retail investors follow suit, with digital gold representing 19% of precious metals holdings among portfolios under $250k. The gates have opened.

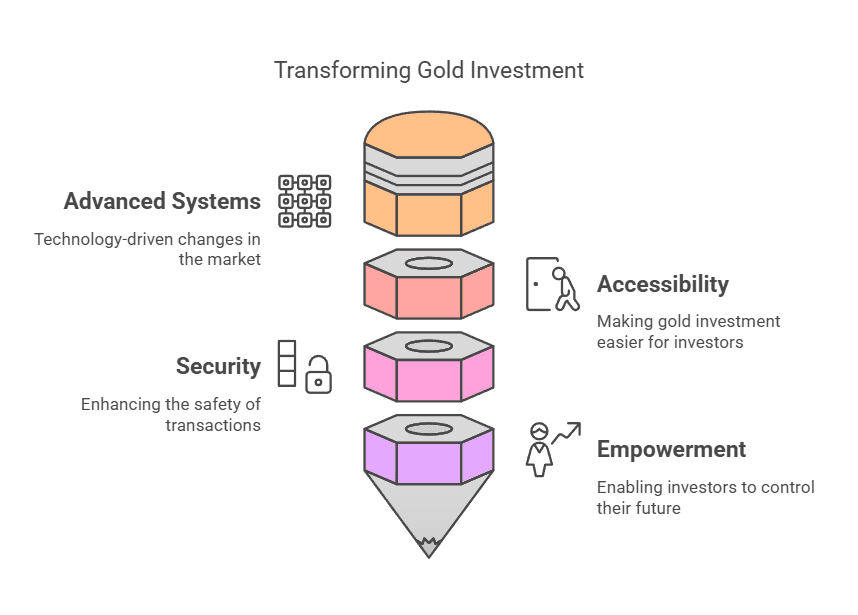

How Blockchain is Changing Gold Trade: Understanding the Impact

Innovative solutions are reshaping the way investors interact with precious metals. The integration of advanced systems is transforming the gold market, making it more accessible and secure. This shift is not just about technology—it’s about empowering you to take control of your financial future.

Enhancing Transparency and Security

Blockchain’s immutable ledger ensures every transaction is recorded and traceable. This eliminates the risk of fraud and boosts trust in the system. For example, the Real World Asset (RWA) sector, including tokenized gold, surged by 6.6%, reaching a market capitalization of $38.8 billion4.

Smart contracts further enhance security by automating processes and reducing human error. These features create a transparent environment where you can confidently invest in gold assets.

Fractional Ownership and Increased Liquidity

Tokenization allows you to own fractions of a gold asset, making investment more affordable. This innovation has led to a $2.5 billion increase in the RWA market within 24 hours4. By breaking down physical gold into digital tokens, liquidity is significantly improved.

This approach lowers risk and adds value to traditional asset trading. You can now participate in the gold market without the need for large capital or physical storage.

| Aspect | Traditional Gold Trading | Blockchain-Driven Gold Trading |

|---|---|---|

| Accessibility | Limited to large investors | Open to all investors |

| Liquidity | Low due to physical constraints | High with digital tokens |

| Security | Relies on physical storage | Immutable blockchain ledger |

| Transparency | Limited traceability | Full transaction history |

These advancements are creating a more dynamic and inclusive market. By leveraging blockchain technology, you can now invest in gold with confidence and ease.

Tokenization of Gold: Bridging Physical Assets and Digital Innovation

Tokenization is revolutionizing the way physical assets like gold are traded, blending tradition with cutting-edge technology. This process allows you to own a fraction of a valuable asset, making investment more accessible and secure. By converting physical gold into digital tokens, blockchain technology is creating new opportunities for investors worldwide.

The Process of Token Creation on the Blockchain

The journey begins with physical gold stored in secure vaults. This gold is then audited and verified to ensure its authenticity. Once confirmed, smart contracts on the blockchain automate the creation of digital tokens, each representing a fraction of the physical asset5.

These tokens are recorded on an immutable ledger, ensuring transparency and reducing risk. Every transaction is traceable, providing you with peace of mind. This innovative process bridges the gap between physical and digital worlds, offering a secure solution for modern investors.

Real-World Use Cases and Investment Opportunities

Platforms like Tether Gold and PAX Gold are leading the way in tokenized gold investments. These digital tokens allow you to trade gold on global exchanges, increasing liquidity and democratizing access to this precious asset5.

BlockAid raised $50 million to expand its blockchain security platform, highlighting the growing emphasis on cybersecurity in this space5. This investment ensures that your assets are protected, making tokenization a reliable solution for gold trading.

By leveraging blockchain technology, you can now invest in gold with confidence. The tokenization process not only enhances transparency but also opens up new opportunities for you to grow your wealth.

Technology’s Role in Modernizing Gold Extraction and Trading

Emerging technologies are reshaping the gold industry, making extraction and trading more efficient and sustainable. From automation to renewable energy, these innovations are transforming an ancient industry into a modern powerhouse. Let’s explore how these advancements are creating a more secure and accessible market for you.

Innovations in Automation and Robotics

Automation and robotics are revolutionizing gold extraction. Advanced machinery now handles tasks like drilling and ore processing, reducing human error and increasing efficiency. For example, high-grade mineralization has been outlined over 100 metres in length to a depth of 200 metres, thanks to automated drilling programs6.

Robotic systems also enhance safety by minimizing human exposure to hazardous environments. This approach not only lowers operational costs but also ensures a more sustainable extraction process.

AI and Predictive Analytics in Exploration

Artificial intelligence is playing a crucial role in gold exploration. Predictive analytics help identify potential mining sites with higher accuracy, reducing risk and boosting efficiency. For instance, AI-driven models analyze geological data to pinpoint areas with high mineralization potential6.

This technology ensures that resources are used wisely, maximizing the value of every investment. By leveraging AI, companies can make data-driven decisions that enhance productivity and profitability.

Renewable Energy and Sustainable Practices

The shift towards renewable energy is transforming mining operations. Solar and wind power are now being used to reduce the environmental impact of gold extraction. This sustainable approach not only lowers carbon emissions but also reduces long-term operational costs7.

By adopting green energy solutions, the gold industry is setting a new standard for responsible resource management. This innovation aligns with global efforts to combat climate change while ensuring a steady supply of precious metals.

Blockchain for Secure Transactions

Blockchain technology ensures secure, real-time tracking of transactions in the gold trade. Every step of the process is recorded on an immutable ledger, providing transparency and reducing the risk of fraud. This system is particularly beneficial for tracking the movement of physical gold bars and digital tokens6.

Platforms like gold tokenization are bridging the gap between physical assets and digital innovation. This secure approach empowers you to invest with confidence, knowing your assets are protected.

- Automation and robotics are making gold extraction safer and more efficient.

- AI and predictive analytics reduce risk and enhance exploration accuracy.

- Renewable energy is lowering the environmental impact of mining operations.

- Blockchain ensures secure, transparent transactions in the gold trade.

These innovations are not just reshaping the gold industry—they’re empowering you to take control of your financial future. By embracing cutting-edge technology, the gold trade is becoming more accessible, secure, and sustainable than ever before.

Investor Benefits and the Future of Digital Gold

The digital revolution is unlocking new opportunities for investors in the gold market. By blending traditional asset value with modern innovation, you can now access secure, transparent, and efficient investment solutions. This shift is not just about technology—it’s about empowering you to take control of your financial future.

Expanding Access to Precious Metal Investments

Fractional ownership is transforming how you invest in gold. By breaking down physical assets into digital tokens, you can now own a fraction of this precious metal. This approach lowers the entry barrier, making gold investment accessible to everyone8.

Platforms like Tether Gold and PAX Gold are leading the way, offering secure alternatives to traditional investments. These solutions reduce fees and increase liquidity, ensuring you can trade with confidence8.

Leveraging Blockchain for Financial Security

Blockchain technology ensures every transaction is recorded on an immutable ledger. This eliminates the risk of fraud and provides full transparency. For example, the Real World Asset (RWA) sector, including tokenized gold, surged by 6.6%, reaching a market capitalization of $38.8 billion8.

Smart contracts further enhance security by automating processes and reducing human error. This innovation creates a trusted environment where you can confidently grow your wealth.

| Aspect | Traditional Gold Investment | Digital Gold Investment |

|---|---|---|

| Accessibility | Limited to large investors | Open to all investors |

| Liquidity | Low due to physical constraints | High with digital tokens |

| Security | Relies on physical storage | Immutable blockchain ledger |

| Transparency | Limited traceability | Full transaction history |

These advancements are creating a more dynamic and inclusive market. By leveraging blockchain technology, you can now invest in gold with confidence and ease. For a deeper understanding of how gold compares to other assets, explore our gold and cryptocurrency comparison.

Emerging Trends and Challenges in Gold Trade Transformation

As the gold trade evolves, new trends and challenges are reshaping the industry. The integration of advanced technologies is creating opportunities, but it also brings hurdles that require attention. From regulatory frameworks to market education, the path forward is both promising and complex.

Regulatory Hurdles and the Need for Market Education

One of the biggest challenges in the gold trade transformation is navigating regulatory frameworks. Governments worldwide are still catching up with the rapid pace of technological innovation. This creates uncertainty for investors and platforms alike9.

Market education is equally crucial. Many investors are unfamiliar with the benefits of digital gold or how blockchain enhances transparency. Educating the market is a vital step to ensure widespread adoption and trust9.

Balancing Technological Innovation with Tradition

While technology is transforming the gold trade, traditional practices still hold value. The challenge lies in integrating these two worlds seamlessly. For example, physical gold stored in secure vaults remains a trusted asset, but its digital counterpart offers greater liquidity10.

Smart contracts and audit mechanisms are bridging this gap. These tools ensure that every transaction is transparent and secure, building trust among investors9.

To stay ahead in this evolving market, you need to stay informed. Platforms like GoldBroker provide valuable insights into precious metal investments, helping you navigate these changes with confidence.

- Regulatory frameworks need updates to support digital innovations.

- Market education is essential for widespread adoption.

- Smart contracts enhance transparency and security.

- Balancing tradition with technology ensures legacy value is preserved.

The future of the gold trade is bright, but it requires careful navigation. By understanding these trends and challenges, you can position yourself to capitalize on the opportunities ahead.

Conclusion

The future of gold investment is here—and it’s digital. With the rise of tokenization, you can now own fractional shares of this timeless asset, breaking down barriers to entry. The integration of advanced systems ensures every transaction is secure, transparent, and efficient11.

Platforms like Tether Gold and PAX Gold are leading the charge, offering digital tokens backed by physical reserves. This innovation not only enhances liquidity but also democratizes access to the market11. Whether you’re a seasoned investor or just starting, these tools empower you to take control of your financial future.

Now is the time to embrace this transformation. By leveraging blockchain technology, you can invest with confidence, knowing your assets are protected. Explore the possibilities of gold coin investments and step into a new era of financial security and growth.

Frequently Asked Questions

How is blockchain changing the gold market?

Blockchain is revolutionizing the traditional gold trade by bringing unprecedented transparency, security, and efficiency. It enables tokenization, allowing for fractional ownership and making gold investment more accessible.

What is tokenization in gold trading?

Tokenization involves converting physical gold stored in secure vaults into digital tokens on a blockchain. These tokens represent fractions of the physical asset, allowing easier trading and investment in smaller increments.

What are the main benefits of using blockchain for trading gold?

Blockchain offers secure and transparent transactions, real-time audit trails, reduced fees, and democratizes access to gold investments by enabling fractional ownership and increasing liquidity.

Does blockchain technology make gold trading safer?

Yes, blockchain significantly minimizes risks by providing an immutable ledger for all transactions, ensuring clear ownership and reducing the chances of fraud or mismanagement compared to traditional physical trading.

What are the challenges for blockchain in the gold trade?

Challenges include navigating regulatory hurdles, the need for extensive market education for investors, and balancing the integration of innovative technology with established traditional practices in the gold industry.

How does blockchain make gold investing more accessible?

Blockchain improves access through fractional ownership via digital tokens, enabling individuals to invest in gold with smaller capital amounts without the need for purchasing entire bars or arranging physical storage, opening the market to more investors.

What is the future outlook for digital gold?

The future of digital gold is promising, combining the traditional stability of physical gold with the efficiency, security, and accessibility of blockchain technology. This hybrid approach is expected to attract more investors and transform the market.