Did you know a one-carat natural diamond can cost up to $4,200? Its lab-grown version might only cost $1,000. This shows how complex the world of precious stones is.

Exploring diamond and gold values, we find a world of rare materials and investment gems. Gemstone pricing is more than looks. It’s about rarity, demand, and investment.

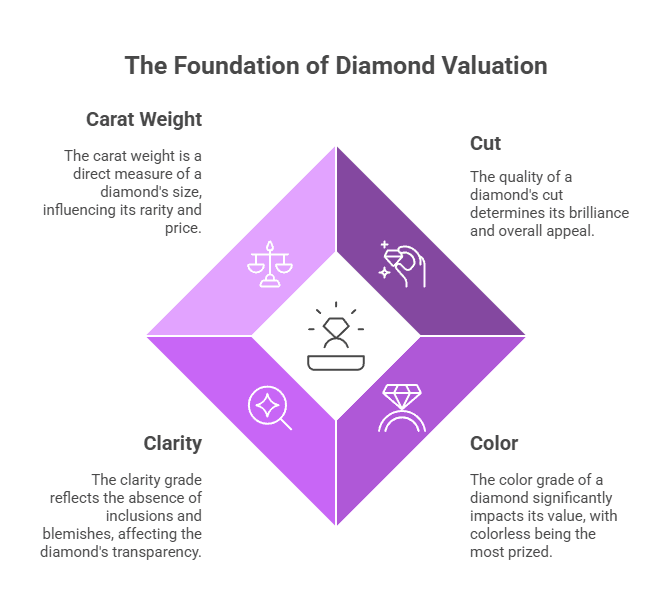

We’ll look into these valuable assets. We’ll see how their value is set and why they’re so wanted. From diamonds’ 4Cs to gold’s weight, our deep dive will give you insights.

Key Takeaways: Is A Diamond Worth More Than Gold

- Natural diamonds retain about 50% of their value after buying

- Lab-grown diamonds have much lower resale value

- Diamond pricing depends on cut, clarity, color, and carat weight

- Gold is a more stable investment than diamonds

- Market demand and economic conditions affect asset values

Understanding the Value Fundamentals of Diamonds and Gold

Diamonds and gold have amazed people for a long time. They are valuable stones and important for investing. Their special qualities and history make them interesting to study.

Each asset has its own special traits. These traits affect their value and how people see them. Knowing these traits helps investors and collectors make smart choices.

Basic Characteristics of Each Asset

Diamonds are made of carbon and are very hard. They also bend light in special ways. Important traits include:

- Extreme durability

- Unique optical properties

- Finite global supply

- Graded through the 4Cs system

Gold is a soft metal but is very valuable. It doesn’t rust and is good at carrying electricity. Important traits include:

- Corrosion resistance

- Electrical conductivity

- High monetary value

- Multiple purity levels

Historical Significance in Trade and Commerce

Diamonds and gold have been key in world trade for a long time. Gold has been used as money for thousands of years. Diamonds became valuable during the Middle Ages.

“Precious metals and stones are not just commodities, but representations of human cultural and economic evolution.”

Market Dynamics and Price Determination

How prices are set for these assets is different. Diamond prices depend on things like cut, clarity, and carat weight. Gold prices are simpler, based on weight, purity, and market rates.

Investors need to understand these differences. It helps them make smart choices in investing in precious stones and metals.

The True Rarity Factor: Debunking Common Myths

Exploring diamonds and gold shows us interesting facts. These facts challenge what many believe. Diamonds are not as rare as people think.

Diamonds are made to seem rare by controlling how many are sold. Big diamond companies manage how many diamonds are in the market. This keeps their value high.

Buy Gold Online: The Smart and Secure Way

Discover the safest and most reliable strategies to buy gold online. Make informed investment decisions and secure your financial future today!

Learn More“Rarity is a complex concept in the world of precious minerals, like diamonds and gold.” – Gemological Research Institute

- Diamond production is carefully controlled by major mining corporations

- Gold occurs in more predictable quantities within the Earth’s crust

- Durability comparison reveals different characteristics for each mineral

Diamonds are very hard, but they’re not as rare as thought. Gold has a steady rarity because it’s found in limited places.

| Mineral | Scarcity Factor | Market Availability |

|---|---|---|

| Diamonds | Controlled Supply | Strategically Limited |

| Gold | Natural Limitation | More Transparent Market |

Knowing these details helps investors and collectors make better choices.

Determining Diamond Value: The 4Cs System

Learning about diamond prices means knowing the gemological factors that affect a stone’s value. The 4Cs – Cut, Color, Clarity, and Carat Weight – are key.

Valuing gems is a detailed task. It requires looking at each diamond’s special traits. We’ll see how these traits work together to value a diamond.

Diamond Cut: The Brilliance Factor

The cut is the most important part of diamond pricing. A great cut turns a rough stone into a stunning gem. Diamond cuts are rated from:

- Excellent

- Very Good

- Good

- Fair

- Poor

Color Grading: Purity of Appearance

Color greatly affects a diamond’s value. The Gemological Institute of America (GIA) has a color scale. Colorless diamonds are the most expensive. Grades G-H are a good mix of quality and price.

Clarity Classifications: Transparency Matters

Clarity shows a diamond’s inner details. Grades are:

- FL (Flawless): Very rare and valuable

- VS2: Good value with few inclusions

- SI2: More affordable, looks clean to the eye

Carat Weight: Size and Value

Carat weight greatly affects price. Bigger diamonds are rarer and cost more. Prices jump at weights like 0.50, 1.00, and 2.00 carats.

“Understanding the 4Cs is crucial for making an informed diamond investment.”

We focus on these factors in order: Cut, Color, Clarity, and Carat Weight. By balancing these, buyers can find great value in a diamond.

Gold Valuation: Weight, Purity, and Market Factors

Knowing how to value gold is key. The investment value of precious metals depends on many factors. Smart investors look at these carefully.

Gold’s value comes from two main things:

- Weight (measured in grams or ounces)

- Purity (shown in karats)

The gold price changes all the time. This is because of the world market. Pure gold, or 24 karats, is the best quality. Lower karats mean there’s alloy mixed in.

- 24K: 100% pure gold

- 18K: 75% pure gold

- 14K: 58.3% pure gold

“The true value of gold lies not just in its weight, but in its refined purity and market perception.” – Gold Market Analyst

Gold buyers check items carefully. They weigh them and check purity. Hallmarks on jewelry tell us about gold content. This helps figure out the market value.

Investors need to watch more than just gold. They should also look at:

- Global economic conditions

- Currency exchange rates

- Supply and demand dynamics

- Geopolitical tensions

Our study shows it’s important to understand these details. This helps make smart choices in the gold market.

Is A Diamond Worth More Than Gold: Direct Comparison

Looking at diamonds and gold as investments shows a complex world. We dive into the details of diamond prices and gold values. This helps investors make smart choices.

When we compare diamonds and gold, we see key differences. These differences make each asset unique:

Price Per Gram Analysis

Diamonds and gold are valued differently. Here’s why:

- Gold’s price stays pretty steady per gram.

- Diamond prices change based on the 4Cs.

- Getting a diamond certified really matters.

Investment Potential Overview

Each asset has its own investment traits:

| Asset | Price Stability | Market Liquidity | Investment Rating |

|---|---|---|---|

| Gold | High | Excellent | ★★★★☆ |

| Diamonds | Moderate | Limited | ★★★☆☆ |

Market Demand Factors

Diamonds and gold have different market demands. Gold is seen as a safe investment. Diamonds are about luxury and feelings. Gold is more reliable for returns, but diamond prices depend on quality.

Diamonds are priced by rarity, while gold is valued by weight and purity.

Knowing these differences helps investors choose wisely in the diamond and gold markets.

Investment Stability: Gold vs Diamonds

Looking at investment gems, gold and diamonds are key. Gold is seen as a safer choice. It stays strong when the economy is shaky.

Let’s look at why gold is better for investing:

- Gold is very easy to sell

- Diamonds are hard to value

- Gold gives more stable returns

The Federal Reserve’s careful approach to interest rates in 2025 makes gold even more attractive. It could gain 27% by the end of the year. This would be its best year since 2010.

“Gold’s enduring stability amidst economic fluctuations solidifies its position as a superior store of value” – Financial Analysts Report, 2024

Investing in gold and diamonds is different:

- Gold has many ways to invest:

- Gold Mutual Funds

- Gold ETFs

- Sovereign Gold Bonds

- Diamonds need special knowledge

Experts say to put 5-10% of your money in gold. It’s widely accepted and easy to sell. While diamonds are special, gold is the safer choice in the market.

Resale Value and Market Liquidity

Investors often look at how easy it is to sell diamonds and gold. They want to know if these items can be sold quickly and for a good price. This affects how valuable they are as investments.

Selling Diamonds in Secondary Markets

Diamonds are hard to sell in the market. Their price changes for many reasons. This makes it tough to sell them fast.

- Individual stone characteristics

- Specific market demand

- Certification quality

- Current market trends

“The diamond market requires specialized knowledge to maximize resale potential.” – Gemological Experts

Gold’s Trading Advantages

Gold is easier to sell than diamonds. Its price doesn’t change much. This makes gold a good choice for those who want stable returns.

| Asset Characteristic | Diamonds | Gold |

|---|---|---|

| Market Liquidity | Low to Moderate | High |

| Resale Ease | Complex | Simple |

| Price Stability | Variable | Consistent |

Investors need to think about what they want before choosing. Gold is good for those who want easy sales. But diamonds need special knowledge to get the best price.

Impact of Economic Conditions on Both Assets

Economic conditions change how we see investment assets, like diamonds and gold. These luxury goods react differently to world financial changes. This makes the market tricky for investors.

When the economy is shaky, commodity markets act in special ways. Gold is often seen as a safe choice, staying steady when things get rough. Diamonds, on the other hand, have price changes linked to how much people spend and what’s trendy in luxury.

“Economic volatility transforms investment strategies, with gold and diamonds offering divergent protective mechanisms.”

Important economic factors that affect these assets include:

- Global market liquidity

- Consumer confidence levels

- Geopolitical tensions

- Inflation rates

- Currency fluctuations

Recent studies show interesting trends in diamond and gold investments:

| Asset | Economic Resilience | Market Volatility |

|---|---|---|

| Gold | High | Low |

| Diamonds | Moderate | High |

The diamonds ETF market shows slow growth, with annual rates around low single digits. Big events like the COVID-19 pandemic have really changed diamond markets. This brings both challenges and chances for investors.

Knowing these economic details helps investors choose wisely between gold and diamonds. No single plan is perfect, but mixing different investments can help manage risks in complex markets.

Mining and Production: Supply Chain Effects

The world of getting precious gems is complex. It affects the value and how sustainable diamonds and gold are. We look into how diamond mining and gold extraction work. These methods shape the global mineral supply chain.

Diamond mining is a tough job. About 1.5 million people worldwide work in it. They make 10-20% of the world’s diamonds.

The process includes:

- Identifying kimberlite ore deposits

- Extensive geological surveying

- Complex separation and processing techniques

- Rigorous quality assessment of precious gems

Diamond Mining Challenges

In places like the Central African Republic, diamond mining is hard. The U.S. Geological Survey (USGS) says over 330,000 carats are mined each year. Sadly, 80% of it is illegally sent out.

Satellite pictures and geology help map these areas. They show where the gems are.

Gold Extraction Methods

Gold mining has its own problems. Artisanal miners make about 12% of the world’s gold. They often use mercury, which harms the environment.

The industry is trying to find better ways to mine gold.

| Mining Type | Global Production | Key Challenges |

|---|---|---|

| Artisanal Diamond Mining | 10-20% of global production | Illegal export, limited regulation |

| Artisanal Gold Mining | 12% of global production | Mercury pollution, informal sector |

Our commitment to understanding these intricate supply chains helps uncover the true value behind diamonds and gold.

Projects like GemFair in Sierra Leone are changing things. They work with about 400 sites. This supports around 6,000 people in diamond mining.

These efforts aim to make mining fair, ethical, and safe for the economy.

Market Demand and Industry Applications

The global gems and jewelry market is very interesting. In 2023, it was worth USD 213.31 billion. It’s expected to grow to USD 255.33 billion by 2032. This shows how important jewelry, industrial uses, and luxury markets are.

Our analysis shows some important points:

- Luxury jewelry market expected to grow to USD 103.32 Billion by 2032

- Asia-Pacific region dominates with over one-third of global market share

- Offline distribution channels continue to lead market strategies

Diamonds and gold are very useful in many fields. They are not just for jewelry anymore. They are also used in new tech and medical fields.

“The future of precious metals lies in their ability to transcend traditional boundaries of luxury and functionality.” – Industry Expert

Industrial uses are getting more advanced. New tech is making diamonds and gold more valuable than before.

| Market Segment | Projected Growth | Key Drivers |

|---|---|---|

| Luxury Jewelry | 7.85% CAGR | Disposable Income |

| Industrial Applications | 5-6% CAGR | Technological Innovation |

| Wedding Jewelry Market | 12-15% Growth | Cultural Significance |

More people have money to spend, and they value handmade things. The market for jewelry and precious metals is changing. Big names like De Beers, Tiffany & Co., and Chow Tai Fook are leading the way with new ideas and caring for the planet.

Long-term Value Retention Analysis

Investors often look at diamonds and gold as long-term investments. We’ll look at how price changes and market trends affect these items.

To understand long-term value, we need to look at past and future trends. Diamonds have special qualities that make them interesting for investors.

Historical Price Trends

Diamond prices have shown some interesting trends. Round brilliant diamonds are known for being stable investments. Their value is influenced by a few key things:

- Superior cut quality makes them more valuable and appealing

- Natural diamonds usually keep about 50% of their original value

- Rare and high-quality stones tend to appreciate more over time

Future Value Projections

Our study found important factors that will shape diamond values in the future:

| Factor | Impact on Value |

|---|---|

| Cut Quality | Significant positive correlation |

| Color Grade | Critical value determinant |

| Carat Weight | Directly proportional to price |

| Certification | Increases marketability |

“Diamonds represent not just a gemstone, but a potential long-term investment strategy.” – Gemological Experts

Investors should watch market trends closely. Diamond values can change due to many things. These include global economic changes, what people want, and new ways to make and check diamonds.

The Role of Certification and Authentication

Certification is key for showing the real value and truth of things like diamonds and gold. It’s very important to know how it helps protect people who buy and collect these items.

Certification makes things clear and trustworthy in the world of valuable items. It focuses on two main things:

- It gives detailed info about what makes an item special.

- It checks if the item meets quality standards.

- It helps keep people safe from scams.

The Gemological Institute of America (GIA) is the top name for diamond certification worldwide. They give detailed reports on diamonds. For man-made diamonds, the International Gemological Institute (IGI) is the go-to place.

“Certification turns a simple stone into a verified, valuable asset with clear worth.” – Diamond Industry Expert

Gold purity certification is just as strict. Hallmarking checks the metal’s quality. This makes investors feel sure about their gold investments.

| Certification Entity | Primary Focus | Key Evaluation Criteria |

|---|---|---|

| GIA | Natural Diamonds | Cut, Color, Clarity, Carat |

| IGI | Lab-Created Diamonds | Color Grading, Clarity Assessment |

Even though certification has many benefits, there are some downsides. It can cost a lot and take a long time. People need to watch out for fake certificates in the market.

Global Market Influences and Price Fluctuations

The world markets for things like diamonds and gold are very complex. Many economic factors affect their prices. Investors need to understand these global dynamics well.

Several key elements impact the valuation of diamonds and gold in international markets:

- Geopolitical tensions

- Currency exchange rates

- Global economic stability

- Supply chain disruptions

- Consumer demand trends

Diamonds have more price changes than gold. Gold prices stay pretty steady. But diamond prices can change a lot because of:

- Rarity of specific diamond characteristics

- Emerging market demands

- Technological advancements in mining

“The global market doesn’t just determine prices; it tells a story of economic interconnectedness.” – Financial Research Institute

Knowing about these global market influences helps investors make smart choices. Diamonds and gold react differently to world economic changes. So, it’s important to diversify.

| Market Factor | Diamond Impact | Gold Impact |

|---|---|---|

| Economic Recession | High Volatility | Safe Haven Status |

| Currency Fluctuations | Significant Price Changes | Moderate Adjustments |

| Global Demand | Luxury Market Dependent | Broad Investment Appeal |

Investors need to stay flexible. They should watch global market signs that affect the prices of these valuable assets.

Practical Considerations for Buyers and Investors

When looking into gemstones and metals, smart investors think about more than just money. Our guide helps you understand the world of luxury items and how to spread out your investments.

Important things for investors to think about include:

- Keeping your investments safe and secure

- Getting the right insurance for valuable things

- How easy it is to buy and sell

- Checking if things are real

Gold is a good choice for investors. It’s easy to carry and trade. Men’s 18K gold wedding bands are a smart pick for several reasons:

- They keep their value when money is tight

- They can protect against rising prices

- They can be enjoyed and also be a smart move

- They might even go up in value

Smart investors see luxury items as smart money moves.

It’s key to know the market. Each metal and gemstone needs its own special knowledge. Diamonds need expert checks, while gold is easier to value.

We suggest mixing metals and gems in your investments. This mix can help protect your money from ups and downs in the market.

Conclusion

Looking at diamonds and gold, we see more than just their prices. Gold is stable over time. Diamonds offer special chances for smart investors. The market of these treasures needs careful thought.

Diamonds are more than money. They last forever and are loved by all. Big, beautiful diamonds keep their value well, making them great for investing.

Choosing between diamonds and gold depends on your investment plan. You should study the market and think about your goals. Both can be good, but they’re different.

We suggest looking at these investments with a clear mind. The real value is in knowing about rarity, demand, and your goals.

Frequently Asked Questions

Is a diamond worth more than gold?

Several factors can make diamonds worth more than gold. Key considerations include the 4Cs (cut, clarity, carat, and color), which determine a diamond’s quality and value. Unlike gold, whose value is largely determined by weight and market demand, diamonds are also valued for their rarity, aesthetic appeal, certification standards, supply chain control by major companies, and demand for diamond jewelry.

Is gold a better investment than diamonds?

When comparing gold to diamonds as investments, gold often stands out for its stability, liquidity, and universal acceptance. Gold price trends are more predictable because gold is influenced by factors such as economic conditions, inflation, and its status as a safe-haven asset. Diamonds, on the other hand, are more subjective in value, depending on quality and market demand, though they offer portability and durability.

How do gold and diamond prices change over time?

The prices of both gold and diamonds fluctuate over time but for different reasons. Gold price trends are often tied to global economic stability, currency values, and geopolitical events, often spiking during times of crisis. In contrast, diamond prices are influenced by market demand, supply chain limitations, and even marketing campaigns, tending to remain steady or grow slowly.

What are the benefits of investing in diamonds vs. gold?

Gold investments offer high liquidity, ease of buying/selling, and relative price stability over time, acting as a hedge against inflation and currency devaluation. Diamonds are valued for their rarity and aesthetic appeal, which can translate into high resale prices for specific certified stones. Diamond investments are also portable and discreet, but lack gold's consistent market value.

Why are diamonds so expensive compared to gold?

Diamonds are expensive because of their scarcity, the intricate processes required for cutting and polishing, the perception of their luxury status, supply chain control, marketing campaigns (e.g., “A diamond is forever”), and high consumer demand, particularly for engagement rings and jewelry.

How does the demand for diamonds and gold affect their prices?

The demand for gold is driven by its use in jewelry, industrial applications, and as a store of value for investors, which is diversified and helps stabilize its price. In contrast, the demand for diamonds is primarily linked to luxury jewelry, especially engagement rings. Gold’s more diversified demand helps stabilize its price compared to diamonds.

Are diamonds considered a precious metal like gold?

Technically, diamonds are not classified as a precious metal, but they are often compared to gold because of their high value and status as symbols of wealth. While gold is a recognized precious metal with global acceptance as a form of currency and investment, diamonds are valued more for their luxury appeal and emotional significance in jewelry.