Welcome to our guide on the current value of 1 tola gold in the United States.

If you’ve ever wondered about the price of this precious metal or how it is measured, you’ve come to the right place.

In this article, we will explore the tola measurement, factors that influence gold rates, and the historical prices of 1 tola gold. Whether you’re a gold investor or simply curious, this information will give you valuable insights into the world of tola gold.

But first, let’s clarify what we mean by “tola.” The tola is a unit of weight commonly used in the gold industry, particularly in South Asia and the Middle East. It is equivalent to approximately 11.66 grams or 0.375 troy ounces. Understanding this measurement is crucial when determining the value of 1 tola gold and comparing it to other weight units like grams and ounces.

So, why is knowing the current value of 1 tola gold important? Gold rates fluctuate daily due to various economic and market factors. By keeping track of the gold rates, you can make informed decisions when buying or selling gold. Additionally, studying historical prices helps you identify trends and plan your investment strategies accordingly.

Now that you have a brief overview, let’s dive deeper into the fascinating world of 1 tola gold.

Key Takeaways:

- The tola is a unit of weight used in the gold industry, equivalent to approximately 11.66 grams or 0.375 troy ounces.

- The value of 1 tola gold fluctuates daily due to economic and market factors.

- Understanding historical prices of 1 tola gold helps identify trends and inform investment strategies.

Understanding the Tola Measurement in Gold Trading

In the world of gold trading, the tola measurement plays a significant role. Let’s delve into what tola is, how it is used as a unit of weight, and its significance in gold transactions.

Tola, also spelled as “tola” or “tolah,” is a traditional unit of measurement for gold and other precious metals commonly used in South Asia, particularly in countries like India, Pakistan, and Bangladesh. One tola is equivalent to approximately 11.66 grams or 0.375 troy ounces.

Comparing Tola to Grams and Ounces:

When it comes to measuring gold, tola is used alongside other internationally recognized units like grams and ounces. While tola is commonly used in South Asia, grams and ounces are widely used measurements globally.

Buy Gold Online: The Smart and Secure Way

Discover the safest and most reliable strategies to buy gold online. Make informed investment decisions and secure your financial future today!

Learn MoreHere’s a quick comparison to help you understand the conversion:

| Tola | Grams | Ounces |

|---|---|---|

| 1 Tola | 11.66 grams | 0.375 ounces |

| 10 Tola | 116.6 grams | 3.75 ounces |

| 100 Tola | 1,166 grams | 37.5 ounces |

This table provides a clear understanding of how tola translates to grams and ounces. It’s essential to be familiar with these conversions in order to compare prices and understand weight measurements in different regions or markets.

Significance in Gold Transactions:

Understanding the tola measurement is crucial for gold traders, investors, and buyers, especially in regions where it is commonly used. It enables them to accurately assess the weight, value, and purity of gold when conducting transactions.

Whether you’re buying or selling gold jewelry, bars, or coins, being knowledgeable about the tola measurement helps ensure transparency and fairness in transactions.

In the next section, we will explore the current market value of 1 tola of gold in the United States and examine the factors that influence the gold rate. Stay tuned!

Current Market Value of 1 Tola of Gold in the United States

In this section, we will delve into the current market value of 1 tola of gold in the United States. Understanding the current gold rate is essential for individuals interested in buying or investing in gold. Various factors influence the gold rate today, such as global economic conditions, demand and supply dynamics, and geopolitical events.

Factors Influencing the Gold Rate Today

The gold rate today is influenced by a multitude of factors. Global economic conditions play a crucial role in determining the price of gold. When economic uncertainties arise, such as inflation, currency fluctuations, or stock market volatility, investors often turn to gold as a safe-haven asset, driving up its demand and price. Similarly, geopolitical events, such as political instability or conflicts, can also impact the gold rate by increasing its appeal as a store of value in uncertain times.

Additionally, supply and demand dynamics have a significant influence on the gold rate. Gold is a finite resource, meaning that its supply is limited. When the demand for gold exceeds its supply, it can lead to higher prices. Conversely, if the demand for gold decreases or if there is a surplus in the market, it can result in lower prices.

Comparing 24K to 22K Gold Tola Prices

When looking at the prices of 1 tola gold, it is important to consider the purity of the gold. Gold is typically available in different karat values, with 24K gold being the purest form. The price of 24K gold tola will be higher compared to 22K gold tola, as 22K gold contains a smaller percentage of gold and higher percentage of other metals.

Investors and buyers often have different preferences when it comes to the purity of gold. Some may prefer the higher purity of 24K gold for investment purposes, while others may prefer 22K gold for making jewelry due to its durability and affordability. Understanding the price difference between 24K and 22K gold tola can help individuals make informed decisions based on their specific needs and preferences.

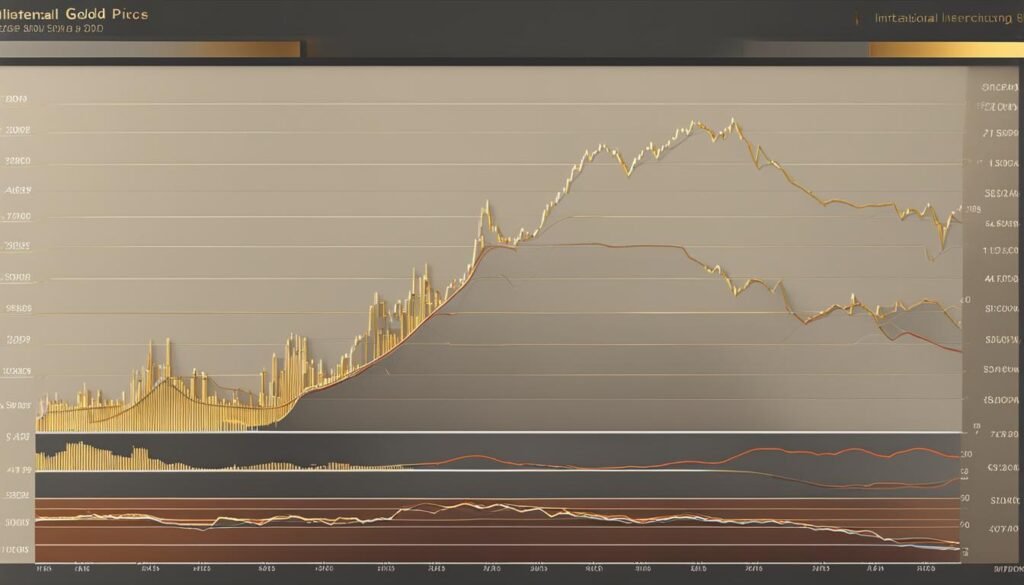

Historical Prices of 1 Tola Gold

Examining the historical prices of 1 tola gold can provide insights into the price fluctuations over time. Gold has a long history as a valuable commodity and has experienced significant price movements throughout different economic cycles. By analyzing historical data, individuals can gain a better understanding of how the value of 1 tola gold has changed and make more informed decisions regarding buying or investing in gold.

To better visualize the historical price fluctuations, please refer to the table below:

| Year | Average Price (per ounce) |

|---|---|

| 2000 | $279 |

| 2005 | $444 |

| 2010 | $1,224 |

| 2015 | $1,160 |

| 2020 | $1,770 |

Please note that these prices are for illustrative purposes only and may not reflect the current gold rates. It is advisable to refer to reliable sources or consult with experts for up-to-date and accurate information on the current price of 1 tola gold.

How the Tola Unit Translates to Grams and Ounces

The tola unit is widely used in the gold industry, especially in countries like India, Pakistan, and Nepal. However, if you’re more familiar with grams or ounces, it’s important to understand how to convert tola measurements to these units. Let’s explore the conversion factor between tola, grams, and ounces and provide practical examples to illustrate the calculations.

First, let’s start with the conversion from tola to grams. One tola is equal to approximately 11.66 grams. To convert tola to grams, you can use the formula:

Grams = Tola × 11.66

For example, if you have 2 tola of gold, the equivalent weight in grams would be:

Grams = 2 × 11.66 = 23.32 grams

Now, let’s move on to the conversion from tola to ounces. One tola is approximately equal to 0.375 ounces. To convert tola to ounces, you can use the formula:

Ounces = Tola × 0.375

For instance, if you have 3 tola of gold, the equivalent weight in ounces would be:

Ounces = 3 × 0.375 = 1.125 ounces

Understanding the conversion between tola, grams, and ounces is essential when dealing with gold weight conversions. Whether you’re buying or selling gold, knowing the equivalent weight in grams or ounces can help you make informed decisions and accurately assess the value of your gold.

| Tola | Grams | Ounces |

|---|---|---|

| 1 | 11.66 | 0.375 |

| 2 | 23.32 | 0.75 |

| 3 | 34.98 | 1.125 |

| 4 | 46.64 | 1.5 |

| 5 | 58.3 | 1.875 |

How Much is 1 Tola Gold in Different US Cities?

This section will explore the variations in the price of 1 tola gold across different cities in the United States. We will analyze the gold price trends in major cities such as New York, Los Angeles, and Chicago, and examine regional market trends that may impact gold pricing. Additionally, we will provide insights on where to find the best rates for purchasing gold.

Gold Price Variations in New York, Los Angeles, and Chicago

When it comes to the price of 1 tola gold, there can be significant variations across different cities in the United States. Cities like New York, Los Angeles, and Chicago are key hubs for gold trading, and the prices in these cities often serve as benchmarks for the regional market.

In bustling metropolises like New York, where the demand for gold is high, you can expect to find competitive prices for 1 tola gold. On the other hand, cities like Los Angeles and Chicago may have slightly different price points due to regional factors, such as local supply and demand dynamics and fluctuations in operating costs.

To get a better understanding of the gold price trend in each of these cities, let’s take a closer look at the regional market trends.

Regional Market Trends in Gold Pricing

Regional market trends play a crucial role in determining the price of 1 tola gold in different cities. Factors such as local economic conditions, consumer demand, and market competition can contribute to price variations.

For example, a city with a strong economy and high demand for gold may have a higher price compared to regions with lower economic activity. Similarly, cities with a larger number of gold dealers and intense market competition may offer more competitive rates for 1 tola gold.

Understanding regional market trends can help you make informed decisions when buying gold. It allows you to identify cities where prices are relatively lower or more stable, increasing your chances of finding the best rates.

Where to Find the Best Rates for Gold

When it comes to purchasing gold, finding the best rates is essential. While prices can vary across cities, there are certain sources that consistently offer competitive rates.

One option is to visit reputable local gold dealers or jewelry stores in your area. These establishments often have competitive pricing and reliable products. Additionally, they may offer services like gold buy-back programs or customization options.

Another option is to explore online platforms that specialize in gold trading. These platforms often have a wide range of options and competitive prices, enabling you to compare rates across different sellers and choose the best deal.

No matter where you decide to buy gold, it’s crucial to do your research and ensure the authenticity and reputation of the seller. Look for dealers or platforms with positive customer reviews, certifications, and reliable customer support.

By understanding the variations in gold prices across different cities and exploring the regional market trends, you can make informed decisions and find the best rates for purchasing 1 tola gold.

International Gold Pricing and Its Impact on US Rates

In the global gold market, international gold prices play a significant role in determining the rates of gold in the United States. The interplay between global gold rates and US rates is governed by various economic factors and market dynamics.

As gold is a globally traded commodity, its prices are influenced by supply and demand dynamics on a worldwide scale. International events such as economic crises, geopolitical tensions, and fluctuations in currency values can significantly impact gold prices. Investors closely monitor international gold prices to make informed decisions regarding their gold investments.

Furthermore, the relationship between global gold prices and US rates is influenced by the value of the US dollar. Since gold is priced in US dollars, any fluctuations in the value of the dollar can have a direct impact on gold prices. For instance, a stronger US dollar usually leads to lower gold prices, as it makes gold more expensive for buyers using other currencies.

On the other hand, a weaker US dollar tends to drive up gold prices, as it increases the affordability of gold for foreign investors. This inverse relationship between the US dollar and gold prices is an essential aspect of understanding the impact of international gold pricing on US rates.

The gold market is also influenced by factors such as central bank policies, interest rates, inflation, and global economic growth. Changes in these variables can create fluctuations in international gold prices, which, in turn, impact the rates of gold in the United States.

By keeping a close eye on global gold rates, investors and traders can better anticipate the direction of gold prices in the US market. Understanding the correlation between international gold pricing and US rates is crucial for making informed investment decisions and navigating the dynamics of the gold market.

Calculating Gold Investment Value: Beyond the Price of 1 Tola

To truly understand the investment potential of gold, it is essential to go beyond simply looking at the price of 1 tola. Gold has long been recognized as a valuable asset that can play a crucial role in a well-balanced investment portfolio. In this section, we will explore the various factors that contribute to the investment value of gold and discuss different strategies for maximizing returns.

Understanding Investment Potential of Gold

Gold is often considered a safe haven investment, particularly during times of economic uncertainty. Its value is not solely dependent on market conditions or geopolitical events, making it a reliable investment option for preserving and growing wealth over the long term. Additionally, gold has a history of retaining its value, making it a store of wealth that can help protect against inflation and currency fluctuations.

Long-Term vs Short-Term Gold Investment Strategies

When it comes to investing in gold, there are two primary approaches: long-term and short-term strategies. Long-term investors typically aim to hold onto their gold investments for an extended period, taking advantage of the potential for price appreciation over time. On the other hand, short-term investors may focus on capitalizing on shorter-term price fluctuations in the gold market.

Both strategies have their merits and risks, and the choice ultimately depends on individual investment goals and risk tolerance. Long-term investment strategies in gold can offer stability and potential for significant returns, while short-term strategies require a more active approach and may offer the opportunity for quick profits.

Gold as a Diversification Tool in Your Portfolio

One of the key benefits of including gold in an investment portfolio is its ability to diversify risk. Gold often has a low correlation with other asset classes, such as stocks and bonds, meaning that its value can move independently of traditional investments. By diversifying your portfolio with gold, you can potentially reduce overall volatility and protect against potential losses in other sectors of the market.

Furthermore, gold’s performance is driven by different factors compared to other asset classes. It has historically performed well during periods of economic downturns or market turmoil, making it a valuable hedge against instability. By adding gold to your portfolio, you can enhance its overall resilience and potentially improve long-term returns.

How to Purchase 1 Tola Gold Bars or Coins

Looking to invest in gold? Here is a step-by-step guide on how to purchase 1 tola gold bars or coins, ensuring you make a secure and informed investment. Whether you prefer the convenience of online platforms or trust the expertise of physical gold dealers, there are several options available to suit your preferences and needs.

If you prefer the convenience of online shopping, there are reputable websites that offer buying gold bars and coins. These platforms provide a wide range of options, allowing you to compare prices and choose the best deal. When purchasing through online platforms, it is essential to verify the credibility and reputation of the seller, ensuring they are a reputable seller with a track record of delivering authentic gold products.

Another option is to visit physical gold dealers in your area. These dealers provide a personal touch and can offer expert advice on the best investment options. When dealing with physical gold dealers, it is crucial to do your research and choose well-established dealers known for their reputable practices.

Regardless of whether you choose to buy online or through physical dealers, it is essential to prioritize the authenticity and quality of the gold products. To ensure you are purchasing genuine gold, look for sellers who provide certificates of authenticity or proof of the gold’s purity. Additionally, consider seeking recommendations from trusted sources or consulting with experienced investors who have previously bought gold.

By following these steps and conducting thorough research, you can confidently proceed with purchasing 1 tola gold bars or coins from reputable sellers, securing a valuable investment for your portfolio.

The Significance of Karat in Gold Tola Pricing

In the world of gold jewelry and investing, the karat value plays a crucial role in determining the price and quality of gold. Understanding the significance of karat is essential for making informed decisions when it comes to buying or investing in gold.

Difference Between 24K, 22K, and 18K Gold

When it comes to gold purity, karat is the measurement used to quantify the amount of pure gold in a piece of jewelry or investment. The higher the karat value, the higher the gold purity. Here’s a breakdown of the most common karat values:

- 24K Gold: Also known as pure gold, 24K gold is 99.9% pure, making it the highest level of purity. It is highly valued for its lustrous appearance and is often used in luxury jewelry.

- 22K Gold: With a karat value of 22, this gold alloy contains 91.7% pure gold and is mixed with other metals to enhance durability. It is commonly used in traditional and ethnic jewelry.

- 18K Gold: This karat value signifies that the gold alloy contains 75% pure gold and 25% other metals. 18K gold strikes a balance between purity and durability, making it a popular choice for both fine jewelry and investment purposes.

It’s important to note that the presence of other metals in the gold alloy affects its color and hardness. For example, 24K gold is naturally yellow, while white or rose gold is achieved by adding other metals to the alloy.

How Karat Affects the Value of Gold Jewelry

The karat value has a direct impact on the value and price of gold jewelry. Higher karat gold, such as 24K or 22K, contains a higher percentage of pure gold, making it more valuable. The craftsmanship and design of the piece also contribute to its overall value, but the karat value is a significant factor in determining the price.

It’s important to consider your personal preferences, budget, and intended use when choosing the karat value for gold jewelry. While higher karat gold is more valuable, it is also softer and more prone to scratches or damage. Lower karat gold, like 18K, offers a balance between purity and durability.

Choosing the Right Karat for Investment and Ornamentation

When it comes to investing in gold, the karat value plays a vital role in determining the investment potential. Higher karat gold, such as 24K, is often favored by investors as it contains a higher percentage of pure gold. However, it’s important to consider market trends, economic factors, and your investment goals before making a decision.

For ornamentation purposes, the choice of karat value depends on personal style, taste, and budget. Consider the durability of the jewelry piece, its intended use, and your level of care in maintaining it. Consult with a trusted jeweler or investment advisor to make an informed decision based on your specific needs and preferences.

Note: The image above illustrates the concept of gold purity and the significance of karat value.

How to Verify Authenticity and Purity of Gold Tola

In order to ensure the authenticity and purity of your 1 tola gold, it is important to follow proper verification procedures. There are various methods that can be employed to test the gold’s purity and confirm its genuineness. Let’s explore some of these methods:

Visual Inspection

An initial visual inspection can provide valuable clues about the authenticity of the gold. Examine the physical characteristics of the gold to look for any irregularities or signs of tampering. Pay attention to the color, texture, and overall appearance of the gold. Authentic gold should have a consistent color and luster.

Hallmarking

Hallmarking is an official certification process that indicates the purity of the gold. Look for hallmarking stamps or symbols on the gold, which provide information about the karat value and authenticity. These marks are typically placed by reputable assay centers and serve as proof of the gold’s quality. Be sure to familiarize yourself with the hallmark symbols used in your region.

Reputable Assay Centers

One of the most reliable methods of verifying gold purity is to have it tested at a reputable assay center. These centers employ advanced techniques and equipment to accurately measure the gold’s purity. They can conduct various tests, such as X-ray fluorescence (XRF) analysis and fire assay, to determine the exact composition of the gold. It is advisable to seek out assay centers that are recognized for their expertise and credibility.

By utilizing these methods, you can ensure that your 1 tola gold is genuine and of the desired purity. Verifying the authenticity and purity of your gold is crucial, especially when making significant investments or purchasing valuable gold jewelry. Take the necessary steps to protect yourself from counterfeit or low-quality gold products.

Gold Price Forecasting: Predicting the Value of 1 Tola

In this section, we will explore gold price forecasting and how to predict the value of 1 tola gold. For investors, staying ahead of market trends and making informed decisions is crucial. By analyzing market trends, economic indicators, and expert predictions, you can gain valuable insights into the future price movements of gold.

Analyzing Market Trends and Economic Indicators

Market analysis is an essential tool for understanding the factors that drive gold prices. By examining historical trends, supply and demand dynamics, and economic indicators, you can identify patterns and make educated forecasts. Pay attention to indicators such as interest rates, inflation rates, GDP growth, and geopolitical events that affect the global economy.

To perform an effective market analysis, consider using various methods and resources, such as technical analysis, fundamental analysis, and sentiment analysis. Technical analysis involves studying price charts, patterns, and indicators to identify potential trends. Fundamental analysis focuses on analyzing economic and financial factors that influence market trends. Sentiment analysis gauges market sentiment and investor psychology through news sentiment, social media analysis, and surveys.

Remember that market trends can change rapidly, so it’s essential to stay updated with real-time data and news sources. Financial news outlets, reputable research firms, and online platforms dedicated to gold market analysis can provide valuable insights and help you make informed decisions.

Expert Predictions and Analysis

Expert predictions play a significant role in gold price forecasting. Financial analysts, economists, and industry experts use their knowledge, experience, and research to provide forecasts on gold prices. Their insights can help you gauge the future direction of gold and adjust your investment strategy accordingly.

When considering expert predictions, it’s crucial to evaluate their track record and the rationale behind their forecasts. Look for experts with a proven history of accurate predictions and consider their analysis in the context of broader market conditions.

Additionally, keep in mind that expert predictions are not infallible. The gold market can be influenced by unforeseen events and external factors, making it essential to employ a diversified approach to gold investment.

Tools and Resources for Gold Investors

As a gold investor, having access to reliable tools and resources is vital for making informed decisions. Several online platforms offer real-time market data, price charts, and analysis tools specifically tailored to gold investors.

Some popular resources include:

- Financial news websites: Stay updated with the latest news, articles, and analysis related to gold prices and market trends.

- Investment research platforms: Access comprehensive reports, research articles, and expert insights to understand the factors influencing gold prices.

- Trading platforms: Utilize trading platforms with advanced charting tools, technical indicators, and customizable features for analyzing gold price movements.

- Gold-focused newsletters: Subscribe to newsletters from reputable sources that provide regular updates on market trends, expert opinions, and investment strategies.

By utilizing these tools and resources, you can stay informed, analyze market trends effectively, and make well-informed investment decisions.

In summary, gold price forecasting involves analyzing market trends, economic indicators, and expert predictions. By staying informed and utilizing reliable tools and resources, you can gain valuable insights into the future value of 1 tola gold and make informed investment decisions.

Customs and Traditions: The Cultural Role of Tola Gold

Tola gold holds immense cultural significance and is deeply intertwined with traditions and customs across different cultures. It is a metal that has been cherished and revered for centuries, symbolizing wealth, prosperity, and heritage.

In various cultural practices, ceremonies, and celebrations, gold takes center stage, playing a pivotal role. Whether it is adorning the bride on her wedding day, embellishing religious idols in temples, or being passed down through generations as a precious heirloom, gold is a cherished part of cultural traditions.

Gold jewelry is often worn during important occasions, such as festivals, birthdays, and anniversaries, serving as a testament to the rich cultural heritage of a community. The intricate designs and craftsmanship of gold ornaments showcase the artistic and cultural prowess of each region.

“Gold is not just a piece of jewelry; it holds the stories of our ancestors, the memories of our traditions, and the essence of our identity.”

Gold plays a significant role in religious ceremonies and rituals as well. It is offered to deities as a mark of devotion and reverence. Temples and religious institutions often adorn their sanctuaries with gold-plated decorations, symbolizing the divine and enriching the spiritual experience.

- Gold is an integral part of traditional customs, such as dowries and gifting, signifying the exchange of blessings, good fortune, and prosperity.

- The cultural importance of gold extends beyond its material value, as it represents a connection to one’s roots and cultural identity.

- Gold also holds sentimentality, harboring memories of special moments and milestone celebrations.

In conclusion, tola gold’s cultural significance cannot be understated. It is deeply rooted in traditions and customs, representing the values, history, and heritage of communities around the world.

Conclusion

After exploring the current market value of 1 tola gold and understanding its measurement, we have gained valuable insights into the world of gold trading. It is crucial to stay informed about the factors that influence the gold rate, such as global economic conditions and geopolitical events. By comparing the prices of 24K and 22K tola gold, we have discovered the differences in value and purity levels.

Examining historical prices has shown us the fluctuations in the value of 1 tola gold over time. This knowledge can help us make informed decisions when buying or selling gold. Additionally, understanding how the tola unit translates to grams and ounces provides us with the necessary tools for accurate weight conversions.

When considering the purchase of 1 tola gold, it is important to be aware of the price variations across different US cities and regional market trends. By staying updated on gold prices in cities like New York, Los Angeles, and Chicago, we can make more informed decisions. Lastly, we have explored the significance of karat value in gold tola pricing and how it affects the value of gold jewelry.

In conclusion, the value of 1 tola gold goes beyond its price. It is essential to understand the market value, measurement, and investment potential of tola gold to make informed decisions. Whether you are purchasing gold as an investment or for ornamental purposes, being knowledgeable about these aspects will help you navigate the world of gold trading more effectively.

FAQ

How much is 1 tola gold?

The current market value of 1 tola gold varies depending on several factors such as global economic conditions, demand and supply dynamics, and geopolitical events. It is important to check the current gold rates to get the most accurate value.

What is the tola measurement in gold trading?

The tola is a unit of weight used in the gold industry. It is commonly used in South Asian countries and is equivalent to approximately 11.66 grams or 0.375 troy ounces. This traditional measurement is still widely used in gold transactions in those regions.

What factors influence the gold rate today?

The gold rate today is influenced by various factors such as global economic conditions, supply and demand dynamics, geopolitical events, and investor sentiment. These factors can cause fluctuations in the price of gold on a daily basis.

What is the difference between 24K and 22K tola gold?

The difference between 24K and 22K tola gold lies in the purity of the gold. 24K gold is considered pure gold as it contains 99.9% gold content, while 22K gold contains 91.7% gold and is mixed with other metals like silver or copper for added strength and durability.

How have historical prices of 1 tola gold changed over time?

Historical prices of 1 tola gold have experienced fluctuations over time due to various factors such as economic conditions, inflation, and market trends. It is important to analyze historical price data to understand the price movements and make informed decisions.

How does the tola unit translate to grams and ounces?

To convert tola to grams, you can multiply the tola weight by 11.664. To convert tola to ounces, you can multiply the tola weight by 0.375. These conversions help in understanding the weight of tola gold in different units of measurement.

What are the gold price variations in different US cities?

Gold prices can vary across different cities in the United States. Major cities like New York, Los Angeles, and Chicago may have different gold price trends due to local market dynamics and demand-supply factors. It is advisable to check the gold prices in specific cities for accurate rates.

How does international gold pricing impact gold rates in the United States?

International gold pricing has a significant impact on gold rates in the United States. Global market trends, economic indicators, and geopolitical events can influence the price of gold globally, which in turn affects the gold rates in the US.

How do you calculate the investment value of gold beyond the price of 1 tola?

The investment value of gold goes beyond the price of 1 tola. It involves considering factors such as long-term investment strategies, diversification benefits, and the role of gold in a well-balanced investment portfolio. It is important to evaluate gold as an investment asset and understand its potential for long-term wealth preservation.

How can I purchase 1 tola gold bars or coins?

There are various options available for purchasing 1 tola gold bars or coins. You can consider buying from reputable physical gold dealers, online platforms, or authorized sellers. It is important to ensure the authenticity and quality of the gold products before making a purchase.

What is the significance of karat in gold tola pricing?

The karat value plays a significant role in gold tola pricing. It indicates the purity of gold and determines the value of gold jewelry. Different karat values such as 24K, 22K, and 18K represent varying levels of gold purity and affect the price of gold jewelry accordingly.

How can I verify the authenticity and purity of 1 tola gold?

There are various methods for verifying the authenticity and purity of 1 tola gold. These include visual inspection for hallmarks, seeking certification from reputable assay centers, and conducting other tests to ensure the quality of the gold product.

How can I forecast the value of 1 tola gold?

Forecasting the value of 1 tola gold involves analyzing market trends, economic indicators, and expert predictions. By staying informed about global economic factors and using tools and resources available to gold investors, you can make more accurate forecasts and informed investment decisions.

What is the cultural significance of tola gold?

Tola gold holds great cultural significance in various customs, traditions, and celebrations. It is often seen as a symbol of wealth, prosperity, and heritage in many cultures. Gold jewelry is commonly worn during special occasions and festivals to showcase status and preserve cultural traditions.