Gold prices are rising due to worries about the economy, strong demand from central banks, and more investor interest.

In a Nutshell: Why Gold Is Going Up

- You will learn the main reasons gold prices are increasing.

- You will understand how economic changes affect gold.

- You will see why central banks and investors buy more gold.

Estimated reading time: 6 minutes

Worried about money? Many people are looking at gold. Gold prices are climbing. This guide explains why gold is going up and becoming more valuable.

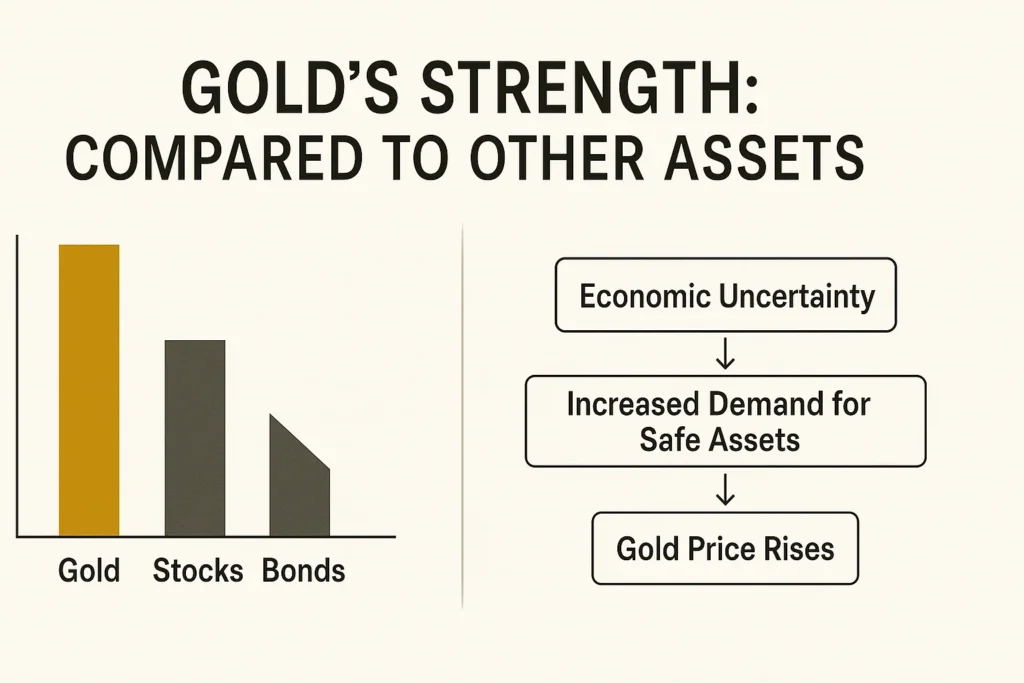

Economic Worries Push Gold Prices

Concerns about a possible recession are growing. This makes investors look for safe places to put their money, like gold. When the economy slows down, gold often becomes more valuable. Goldman Sachs forecasts that gold could reach $3,880 an ounce in such times.

Also, central banks might cut interest rates. Lower rates can make the U.S. dollar weaker. This makes gold more attractive to buyers.

A low interest rate environment also means other safe investments, like government bonds, pay less. This boosts gold’s appeal. Gold acts as a safe haven during recession.

Central Banks Buy More Gold

Central banks around the world are buying a lot of gold. This is a big reason for the price increase. They want to spread out their money. Sometimes, they want to rely less on the U.S. dollar.

This consistent demand from central banks keeps gold prices moving higher. You can learn more about central bank gold purchases.

Investors Choose Gold

More investors are putting money into gold. This also helps explain why gold is going up.

Buy Gold Online: The Smart and Secure Way

Discover the safest and most reliable strategies to buy gold online. Make informed investment decisions and secure your financial future today!

Learn More- Gold ETFs: These funds let you own gold without holding the physical metal. More money flowing into gold ETFs means higher demand. This supports gold prices. Western investors, especially in the U.S., are a big part of this trend.

- Protecting Money: People are moving some of their money into gold. They see it as a way to protect against stock market drops. Even a small shift towards gold can greatly affect its price. If you are interested in how to invest, check out how to invest in gold.

Global Shifts Affect Gold

Some countries are using the U.S. dollar less for their money reserves. This is called de-dollarization. It makes them buy more gold. Also, global trade policies are uncertain. Trade tensions, like new taxes on goods, can make the economy feel shaky. This pushes gold prices up.

World events also play a role. Geopolitical tensions create market uncertainty. This leads to more demand for safe assets like gold. This general environment of uncertainty helps gold’s price.

- Watch the Economy: Pay attention to news about recessions and interest rates.

- Check Central Banks: See if central banks are buying more gold.

- Look at ETFs: Notice if more people are investing in gold funds.

- Think Global: Understand how world events and trade affect gold.

What’s Next for Gold Prices?

Most experts think gold prices will keep rising. Most analysts predict estimates between $3,560 and $3,925 by late 2025. Goldman Sachs forecasts a possible high of $3,700. Some bullish scenarios even suggest prices could reach $4,000. This could happen if the economy faces more challenges.

As of June 7, 2025, gold prices were around $3,309.95 per ounce. This is a bit lower than recent peaks but still much higher than in past years. The average price in early 2025 was $2,860. This was a 38% increase from the same time in 2024. Central banks remain net buyers of gold, keeping demand strong. For more detailed insights, check the gold price outlook.

A simple tool to see how gold value changes.

Gold Value Change Calculator

Conclusion

The rise in gold prices comes from many things. These include economic worries, strong demand from central banks, and more interest from investors. Gold remains a good asset for protecting your money.

This is true as market uncertainty continues. Many forecasts suggest gold will stay in a higher price range through 2025.

Your Questions About Why Gold Is Going Up Answered (Simply)

Why are gold prices rising in 2025?

How do interest rates affect gold prices?

Do central banks buy a lot of gold?

What are gold ETFs?

How does de-dollarization impact gold?

What is the forecast for gold prices in 2025?

Is gold a good investment during a recession?