The richest 1% have almost doubled the wealth of the whole world in just two years. This shows how important smart investing is. Gold coin investing is a key way to keep and grow wealth.

Investing in gold coins is a solid choice. Our guide will help you understand how to buy gold bullion and numismatic coins. You’ll learn about the market, how to invest, and the chances for profit.

Gold is special because it’s not tied to anyone else’s success. This makes it safer for your money. It helps you build a strong and varied investment portfolio.

Key Takeaways: How to Buy Gold Coins

- Understand the basics of gold coin investing

- Learn about different gold coins and their value

- Discover how to buy and store gold coins

- See why gold is important for keeping wealth safe

- Get insights into market trends and economic signs

Understanding Gold Coins as an Investment Asset

Gold coins are a smart way to invest in precious metals. They help diversify your money and keep it safe from economic ups and downs.

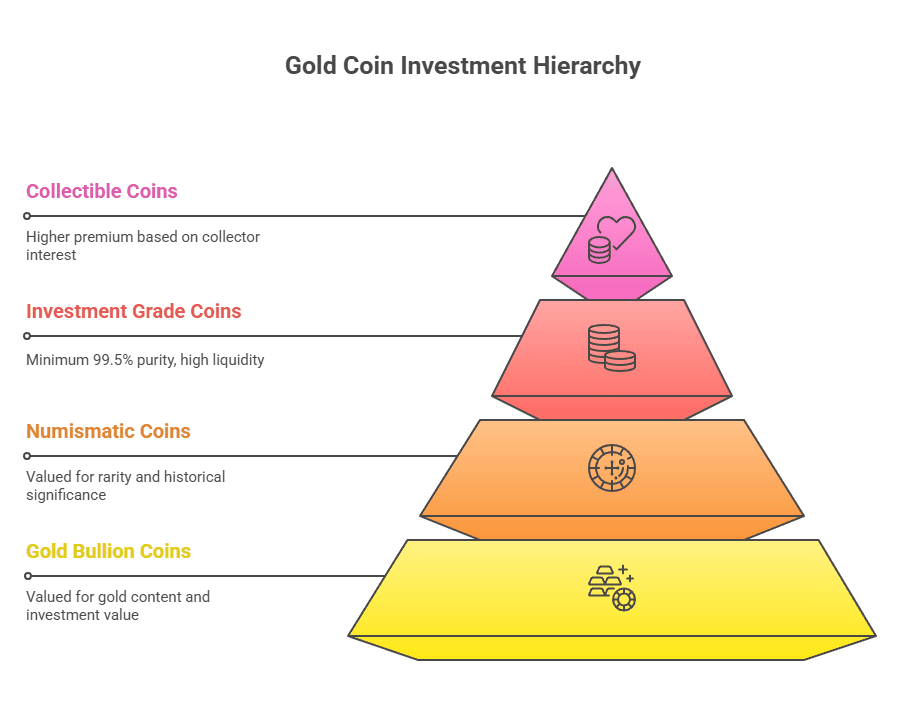

Gold coins come in two main types: gold bullion coins and numismatic coins. Each type has its own special features that fit different investment plans.

Different Types of Gold Coins Available

Gold bullion coins are loved for their gold content and investment value. Some well-known ones are:

- American Gold Eagles

- Canadian Gold Maple Leafs

- South African Krugerrands

- Austrian Gold Philharmonics

Historical Significance of Gold Coins

“Gold coins are not just investments; they are tangible pieces of financial history.”

For centuries, gold coins have been a store of value when money is tight. Experts say to put 5-10% of your money in gold to protect it from inflation.

Investment Grade vs Collectible Coins

| Investment Grade Coins | Collectible Coins |

|---|---|

| Minimum 99.5% purity | Valued for rarity and historical significance |

| High liquidity | Limited market demand |

| Close to gold spot price | Higher premium based on collector interest |

When picking gold coins for collecting or investing, think about purity, growth potential, and how easy they are to sell. Doing your homework will guide you in this exciting field.

Benefits of Investing in Gold Coins

Gold investment is a smart way to protect and grow your wealth. Gold coins are real assets. They offer many benefits for diversifying your portfolio.

Our analysis shows many good reasons to invest in gold coins:

- Hedge against inflation: Gold keeps its value when the economy is shaky

- Portfolio diversification: It lowers risk by mixing with other investments

- Tangible asset: You own it physically and can sell it quickly

- Global recognition: It’s easy to trade in markets worldwide

Gold shines as an investment during tough times. History shows gold stays strong when stocks fall. In the 2007-2009 recession, gold prices went up 25%. But the S&P/ASX 200 Index dropped nearly 50%.

“Gold represents wealth preservation in its most elemental form” – Financial Experts

Gold coins stand out because they’re real. They’re not like stocks or bonds. Gold is a solid value that doesn’t rely on companies or interest rates. About 90% of gold demand is for jewelry and investment.

Buy Gold Online: The Smart and Secure Way

Discover the safest and most reliable strategies to buy gold online. Make informed investment decisions and secure your financial future today!

Learn More| Investment Characteristic | Gold Coins Advantage |

|---|---|

| Liquidity | Easily convertible to cash globally |

| Market Stability | Low correlation with traditional financial markets |

| Potential Returns | Value appreciation during economic uncertainties |

Gold coins have many benefits. But, think about storage costs and no income. Talking to financial experts can help create a plan that fits your goals.

Current Market Overview for Gold Coin Investment

The gold market is exciting and stable for smart investors. Our study shows big chances for those looking into gold coins.

Gold prices have gone up by almost 30% in a year. This shows gold’s strong value in today’s world. Now, investors can choose from owning gold, investing in gold stocks, or buying gold-backed securities.

Market Trends and Price Analysis

To understand gold prices, we look at important economic signs and market changes. We found key things that affect gold coin prices:

- Global economic conditions

- Interest rate changes

- Inflation rates

- Geopolitical events

Factors Affecting Gold Coin Values

Gold coin values depend on a few important things:

| Factor | Impact on Value |

|---|---|

| Purity | Higher purity means more value |

| Rarity | Scarce coins cost more |

| Condition | Perfect coins get higher prices |

Economic Indicators to Watch

Investors should keep an eye on these key economic signs:

- Inflation rates

- Currency strength

- Central bank actions

- Geopolitical stability

“Gold remains a timeless investment vehicle, offering stability in uncertain economic landscapes.” – Financial Analyst

Physical gold is very liquid. It lets investors turn their gold into cash fast. Online retailers now offer good prices, making gold coin investments easier than ever.

How to Buy Gold Coins

Buying gold coins needs careful thought and planning. We’ll look at the best ways to buy gold online and in local shops. This will help you make smart choices for your investments.

When looking for gold coin dealers, you have many options:

- Online precious metal platforms

- Local coin shops

- Brokerage firms

- Banks

- Specialized bullion dealers

Buying gold online has big benefits. Digital sites are easy to use often cheaper than stores. You can check prices, make sure coins are real, and buy from home.

“Investing in gold coins requires diligence and strategic approach to maximize potential returns.”

When buying gold coins, think about these things:

- Dealer reputation and credentials

- Pricing transparency

- Authentication processes

- Delivery and storage options

Do your homework before buying. Look up seller reviews, check their credentials, and know the extra costs. Investment-grade gold must be at least 99.5% pure to be good quality and worth it.

Places like Fidelity and Interactive Brokers let you buy gold directly. This adds more options for those wanting to spread out their investments.

Choosing Between Bullion and Numismatic Coins

Gold coin investments have two main types: bullion and numismatic coins. Each offers different chances for investors to grow their money.

Understanding Bullion Coins

Bullion coins are mostly about their gold value. They usually cost close to the gold spot price. They’re great for those who want to invest in pure gold.

Some popular bullion coins are:

- Canadian Gold Maple Leaf

- Austrian Gold Philharmonic

- Australian Gold Kangaroo Nuggets

- South African Gold Krugerrands

Evaluating Numismatic Value

Numismatic coins are more complex. They gain value from being rare, having history, and being sought after by collectors. How well they are graded matters a lot.

Numismatic coins can grow in value more than their gold worth because of their unique traits and demand.

Price Premiums and Markups

Knowing about gold coin premiums is key for smart investing. Here’s a quick look at the main points:

| Coin Type | Average Premium | Investment Considerations |

|---|---|---|

| Bullion Coins | 3-5% | Lower cost, closer to gold spot price |

| Numismatic Coins | 10-50% | Higher potential returns, greater market expertise required |

Investors need to think about what they want. Bullion coins are simple and cost-effective. But numismatic coins might offer more profit, but they’re riskier and harder to understand.

Popular Gold Coin Options for Investors

Investors looking for gold coins have many great choices. The market has a wide range of coins. They offer both good investment potential and historical value.

- American Gold Eagle: A top choice from the U.S. Mint, featuring iconic American imagery and 22-karat gold composition

- Canadian Gold Maple Leaf: Renowned for its exceptional 99.99% purity and distinctive maple leaf design

- South African Krugerrand: The first modern bullion coin, representing a pioneering investment option

- Austrian Gold Philharmonic: Europe’s most popular gold coin, celebrating musical heritage

“Gold coins represent more than just a financial investment – they’re a tangible connection to history and economic stability.” – Precious Metal Experts

Each gold coin has its own special features. The American Gold Eagle has a patriotic design and government backing. The Canadian Gold Maple Leaf is known for its high purity.

| Coin Type | Purity | Origin | Typical Weight |

|---|---|---|---|

| American Gold Eagle | 22 karat | United States | 1 oz |

| Canadian Gold Maple Leaf | 24 karat | Canada | 1 oz |

| South African Krugerrand | 22 karat | South Africa | 1 oz |

| Austrian Gold Philharmonic | 24 karat | Austria | 1 oz |

When picking gold coins, think about purity, design, history, and numismatic value. The best choice depends on your investment goals and what you like.

Finding Reputable Gold Coin Dealers

Finding the right gold coin dealer is key for a safe and profitable buy. The world of precious metals needs careful steps to protect your money. You want to work with trustworthy pros.

When looking for good gold dealers, think about a few things for a safe buy. The coin dealer check involves important steps:

Online vs Local Dealers

There are two main choices for buying gold coins:

- Online dealers might cost less because they have lower costs

- Local dealers give you a chance to talk face-to-face and get your coins right away

- Online sites usually have more coins to choose from

Verification and Authentication Process

Checking if coins are real needs careful work. Here are some tips for checking:

- Look if the dealer is in professional groups

- Check if they are in places like the National Futures Association

- Ask for proof that each coin is real

“A good dealer will always tell you where the coin came from and how pure it is.”

Dealer Credentials to Look For

When picking a gold coin dealer, look for these important things:

- See if they belong to known numismatic groups

- Check what others say about them online

- Make sure their prices and fees are clear

- Look at how long they’ve been in the business

Pro tip: Always compare dealers’ prices with the current gold price to make sure you’re getting a good deal.

Understanding Gold Coin Pricing and Premiums

Gold coin investments need a good understanding of prices. The gold spot price is the main price for coins. But, many things can change the final cost. Dealers add extra money based on the market.

Important things that affect gold coin prices include:

- Current gold spot price

- Coin rarity and historical significance

- Mintage numbers

- Market demand

- Manufacturing costs

Our study shows that premiums can really affect your investment. Investment-grade gold bars are 99.99% pure gold. This purity affects their value. Bullion coins usually have lower premiums than collectible coins.

“Gold appreciates, on average, by 10% per year and is considered a consistent source of value over time.” – Investment Research Report

Gold market analysis says investors should look at prices carefully. Gold prices have hit new highs over $2,700 per ounce. This is a great chance for smart investors. Keep an eye on spot prices and know how dealers make their money.

Experts say gold should be only 5% to 10% of your portfolio. When buying gold coins, compare prices from different trusted dealers. This helps you get a fair deal.

Storage Solutions for Gold Coins

Keeping your gold coins safe is very important. You need to pick the right place to store them. This keeps your metals safe and easy to get to.

There are many ways to store gold coins. Each has its own good points and things to watch out for. Our guide will show you the best ways to keep your gold safe.

Home Storage Security Measures

Storing gold coins at home is handy. But, you must make sure it’s very safe. Here are some key steps:

- Get a top-notch fire-safe with strong locks

- Choose secret spots to hide your coins

- Put in a good home security system

- Only tell people you really trust about your coins

Professional Storage Options

Going for professional storage is a smart move. It gives your coins the best protection. Here are some top choices:

| Storage Option | Security Level | Cost Range |

|---|---|---|

| Bank Safety Deposit Boxes | Moderate | Low to Moderate |

| Private Depository Vaults | High | Moderate to High |

| Allocated Storage Services | Very High | High |

Insurance Considerations

Getting your gold coins insured is key. Most homeowners’ insurance doesn’t cover precious metals well. Special insurance for metals offers:

- Full value coverage

- Protection from theft

- Options for coverage worldwide

- Flexible policy terms

“Proper storage and insurance are not expenses, but investments in protecting your wealth.” – Financial Security Expert

Choosing the right storage is about balance. Think about safety, ease, and cost. Look at your needs, how much you have, and how much risk you can take.

Authentication and Grading of Gold Coins

Investing in gold coins means knowing about coin grading and numismatic authentication. It’s key to protect your investment. Professional grading tells you what you’re buying. It shows the coin’s condition and value.

It’s smart to use reputable coin grading services like NGC and PCGS. They test gold purity and check coins for investors.

“Quality verification is the cornerstone of smart gold coin investment” – Professional Numismatist

Important parts of coin authentication are:

- Detailed visual inspection

- Precise metal content analysis

- Condition assessment using standardized grading scales

- Verification of coin origin and mint marks

Gold coin grading looks at several important things:

- Physical Condition: Checking wear, scratches, and preservation

- Mint State: Seeing if the coin looks new

- Rarity: Finding out what makes the coin special

Coins graded by pros in sealed holders are more valuable. They show their metal and quality well. This makes them great for collectors and investors.

Tax Implications of Gold Coin Investment

Investing in gold coins has its own tax rules. The IRS sees gold coins as collectibles. This means there are special tax rules for your gold investments.

Gold investment taxes can be tricky. Here are the main tax points investors should know:

- Capital gains on gold coins are taxed at a maximum rate of 28%

- Short-term holdings (less than one year) are taxed as ordinary income

- Long-term holdings get better tax treatment

IRS reporting rules are key for gold coin investors. You might need to show certain documents, like:

- Schedule D on Form 1040

- Form 1099-B for big sales

- Keeping track of buy and sell prices for tax

Gold investments have special tax benefits if managed well. Talking to a tax expert can help improve your investment plan.

Planning is key for handling gold investment taxes well. Gold IRAs offer a different way to invest with tax benefits. These special retirement accounts let you hold precious metals and might lower your taxes.

We suggest working with trusted dealers and keeping good records. This ensures you follow IRS rules. Knowing the tax rules helps you make better choices for your gold coin investments.

Common Pitfalls to Avoid When Buying Gold Coins

Buying gold coins can be a good move, but you need to be smart. Our guide will teach you how to avoid scams and market tricks.

Knowing the risks is key for gold coin investors. Scammers and fake coins can ruin your investment fast.

Red Flags to Watch For

- Dealers pressuring you for immediate purchases

- Promises of unrealistic investment returns

- Prices significantly below current market rates

- Lack of transparent documentation

- Reluctance to provide coin authentication details

Counterfeit Detection Tips

Staying safe from fake coins needs careful checks. Here’s how to inspect gold coins:

- Check the coin’s precise weight and dimensions

- Examine the metallic sound when gently tapped

- Verify authenticity through professional grading services

- Compare against certified reference coins

Price Manipulation Warning Signs

| Warning Sign | Potential Risk |

|---|---|

| Artificial scarcity claims | Inflated pricing strategies |

| Misleading historical price data | Deceptive market representation |

| Unverifiable investment claims | Potential market manipulation |

Stick to reputable, established dealers for safe buying. Doing your homework can lower your risks a lot.

“Knowledge is your best defense against gold coin investment pitfalls.” – Investment Expert

Stay alert, do your homework, and be smart when buying gold coins.

Gold Coins in Investment Portfolios

Adding gold coins to your investment mix can be smart. Experts say to put 5-15% of your money into gold. This helps protect against market ups and downs.

Gold coins have special benefits for your investment plan:

- They don’t move with the stock market

- They fight inflation

- They stay strong when the economy is weak

- They are real things with true value

Think about your goals before adding gold coins. Unlike stocks or bonds, gold doesn’t pay out income. Its main role is to grow in value and protect your money.

“Diversification is the only free lunch in investing” – Modern Portfolio Theory

When picking gold coins, look at these top choices:

| Coin Type | Purity | Recommended Allocation |

|---|---|---|

| American Gold Eagle | 91.67% | 3-5% |

| Canadian Gold Maple Leaf | 99.99% | 2-4% |

| South African Krugerrand | 91.67% | 3-5% |

Talk to a financial advisor to find the right mix of gold coins. Gold is great for protection, but it shouldn’t be all you have.

Selling Gold Coins: Exit Strategies

It’s important to have a good plan for selling gold coins. We plan carefully and know the market well. When you want to sell your gold, you have many choices.

There are several ways to sell gold coins:

- Precious metals dealers

- Coin buyback programs

- Online marketplaces

- Auction houses

- Peer-to-peer platforms

When to sell is very important. Gold prices change a lot because of the economy. When there’s big news, like in 2022, gold prices might go up. This is a good time to sell.

| Selling Channel | Pros | Cons |

|---|---|---|

| Precious Metals Dealers | Immediate cash, expert appraisal | Potentially lower prices |

| Online Platforms | Wider market reach | Shipping risks |

| Auction Houses | Higher prices for rare coins | Longer selling process |

“The key to successful gold coin liquidation is understanding market conditions and having multiple selling strategies.” – Gold Investment Expert

Getting ready to sell gold coins is key. Make sure you have all your documents ready. Knowing the difference between buy and sell prices helps. Some dealers even promise to buy back your coins, which is reassuring.

Legal and Regulatory Considerations

Investing in gold coins needs careful attention to laws and IRS rules. It’s important to know the rules for these special assets.

Important legal points for gold coin investors include:

- Reporting big precious metals deals to the IRS

- Rules in each state for buying gold

- Taxes on gold investments

- IRS rules for precious metals

The IRS sees physical gold as a collectible. This means it has its own tax rules. Long-term gains on gold coins are taxed at a max of 28%. This is higher than many other investments. So, investors must keep track of their buys and sells for tax reporting.

Knowing the laws is key to protecting your gold investment. It helps you follow federal and state rules.

When thinking about gold coin investments, we suggest:

- Talk to a tax expert who knows precious metals laws

- Keep detailed records of all gold coin deals

- Report gold sales on Schedule D of Form 1040

- Keep up with changes in gold laws

Gold IRAs have extra rules to follow. These special retirement accounts must follow strict IRS rules. Investors need to work with custodians who know the laws well.

Conclusion

Our gold coin investment guide shows that investing in precious metals is a smart move. American Eagle Gold Coins are a great choice for new investors. They are made of 22-karat gold and are backed by the government.

The United States has the most gold reserves in the world. This makes gold coins a key part of a good investment plan. It’s wise to look at different coins like American Eagles, South African Krugerrands, and Austrian Philharmonics.

Gold coins are more than just collectibles. They are solid assets that protect against inflation and market ups and downs. By picking the right coins and checking their realness, we can make our portfolios stronger.

Investing in gold coins needs ongoing learning and careful planning. Always think long-term. Talk to financial experts to make sure your gold coin investments fit your goals and how much risk you can take.

Frequently Asked Questions About How to Buy Gold Coins

Where can I safely buy gold coins online?

You can safely buy gold coins from reputable online precious metals dealers like GoldBroker, APMEX, JM Bullion, Kitco, and GoldCore. Look for companies offering insured shipping, secure storage, membership in professional organizations, and clear authentication processes. Always compare their prices against the current spot price of gold.

What are the best types of gold coins to buy?

Consider two main categories: bullion coins (like American Gold Eagle, Canadian Gold Maple Leaf, South African Krugerrand, Austrian Gold Philharmonic), valued for gold content and trading near spot price, and numismatic coins, valued for rarity, history, and condition, often carrying higher premiums. Pay attention to purity, typically 24k or 22k.

How much should I invest in gold coins for diversification?

Financial advisors generally recommend allocating 5-15% of your investment portfolio to gold as a safe haven asset to hedge against market volatility and inflation. Your specific allocation should align with your investment goals, risk tolerance, and be part of a long-term asset allocation plan.

What taxes do I pay when selling gold coins?

The IRS treats physical gold as a collectible, subject to specific tax rules. Capital gains on gold coin sales are taxed at a maximum rate of 28% (long-term). Short-term gains (held less than a year) are taxed as ordinary income. Keep detailed records, consult a tax professional, and be prepared to potentially submit forms like 1040, Schedule D, and 1099-B.

How do I verify the authenticity of gold coins?

To ensure authenticity, buy from reputable dealers with good reputations and professional memberships. Look for detailed documentation about the coins. Consider using professional coin grading services like NGC or PCGS for third-party verification. Also, check the coin's weight and dimensions against standard specifications.

What affects the value of my gold coins?

The value is influenced by the current spot price of gold, coin rarity, historical significance, condition (for numismatic coins), mintage numbers, market demand, and gold purity (24k or 22k). Economic conditions like interest rates, inflation, geopolitical risk, and market volatility also play a significant role.

What is the safest way to store gold coins?

Secure storage is crucial. Professional options like private depository vaults or allocated storage services are generally recommended over home storage. If storing at home, use a high-quality, fire-resistant safe and a good security system, and ensure you have adequate insurance specifically for precious metals, as standard homeowners policies may not cover their full value. Bank safe deposit boxes are another option.