The Playbook To Buy Gold Coins & Build Real Wealth

Most people lose money investing. They gamble. We give you the asymmetric information you need to make intelligent decisions, not bets. This is your unfair advantage in the gold market.

Start The Training

The Only Number That Matters: Live Gold Price

Knowledge is leverage. Know the price before you ever talk to a dealer. This is your baseline.

24-Hour Market Action

We Give You An Unfair Advantage

Deep Analysis

We dissect the market so you get actionable intelligence, not useless noise or a sales pitch.

Scam Identification

We expose the dirty tricks and scams that dealers use to rip off uninformed buyers. This alone will save you thousands.

Actionable Blueprints

We provide step-by-step frameworks for buying, storing, and managing your assets like a professional.

The Complete Gold Investment Guide

Everything you need to know to start investing in physical gold coins. Master the fundamentals.

Getting Started with Gold Coins

Determine Your Investment Goals

Define your mission: long-term wealth defense, portfolio diversification, or inflation hedging.

Choose the Right Coins

Focus on common bullion like Eagles or Maples. Consider their premiums, liquidity, and recognition.

Secure Storage Solutions

Decide between a home safe, bank box, or insured depository. Your security plan is non-negotiable.

Pro Investment Tips

Start Small

Make a small initial purchase to learn the process. Experience is the best teacher.

Buy from Reputable Dealers

Vet your dealer. Non-negotiable criteria: transparent pricing and an ironclad reputation.

Monitor Market Trends

Understand the economic signals—inflation, interest rates, geopolitics—that drive gold prices.

Diversify Your Holdings

Consider a mix of different coin types and weights to optimize for both liquidity and value.

Why The Smart Money Chooses Gold

It’s An Inflation Killer

While your dollars lose value every second, gold has preserved wealth for 5,000 years. It’s the ultimate defense.

You Actually Own It

Your stocks are just numbers on a screen. Gold is a real, tangible asset in your hand. No counterparty risk.

It’s Portfolio Armor

When markets crash, gold doesn’t. It’s the financial bedrock that provides stability when everything else is chaos.

The 5,000-Year Track Record of Gold

560 BC

The first pure gold coins are created, making wealth portable and standardized for the first time.

1792

The U.S. Coinage Act puts America on a gold and silver standard, building the dollar on a rock-solid foundation.

1933

FDR makes private gold ownership illegal, proving that governments, not markets, are the biggest threat to your wealth.

1971

Nixon detaches the US Dollar from gold, starting an era of endless money printing and currency devaluation.

1975

Americans can legally own gold again, creating the modern private investment market we operate in today.

The Four Workhorse Coins: A Comparison

| Coin | Purity | IRA Eligible? | Best For |

|---|---|---|---|

| American Eagle | .9167 (22k) | Yes | Durability & Recognition |

| Canadian Maple Leaf | .9999 (24k) | Yes | Maximum Purity |

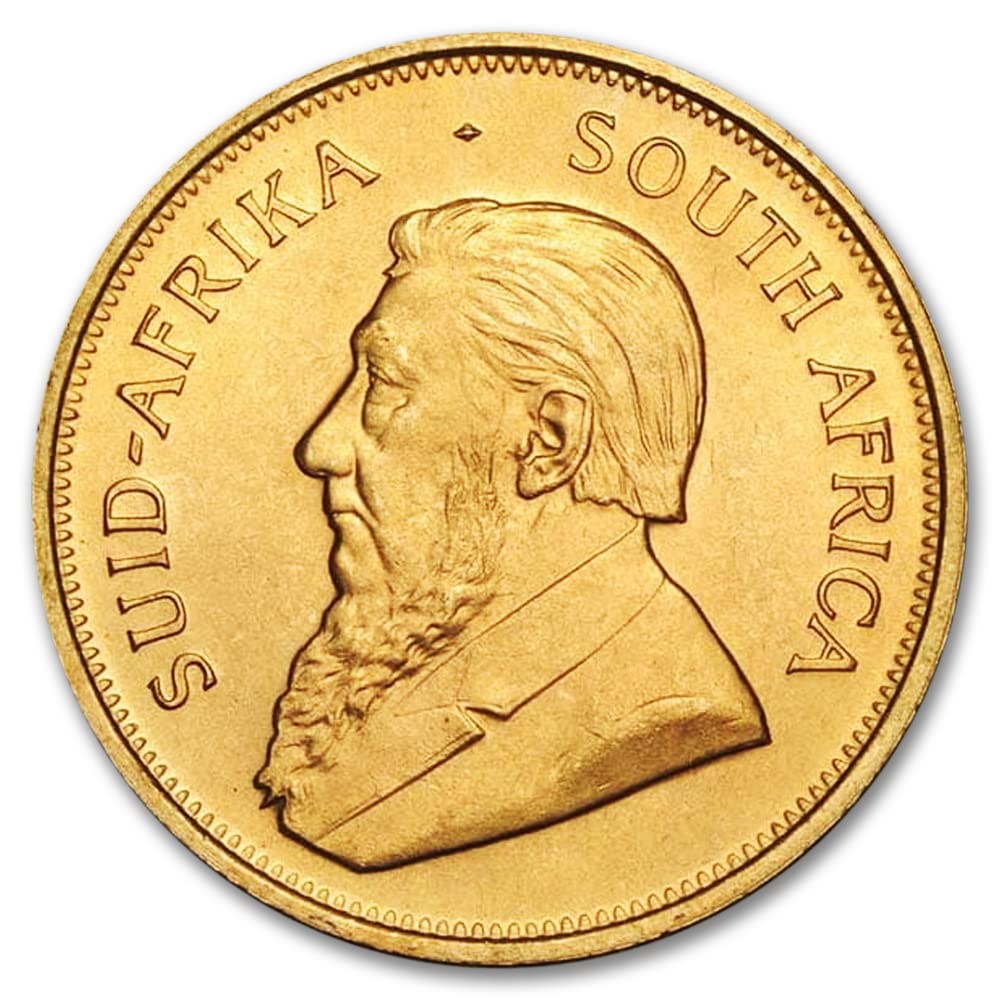

| Krugerrand | .9167 (22k) | Yes | Liquidity & History |

| Austrian Philharmonic | .9999 (24k) | Yes | Artistry & European Markets |

Our Top-Tier Product Recommendations

1 oz American Gold Eagle Coin

The cornerstone of any serious portfolio. A Gem Uncirculated, random-year coin offering maximum value and liquidity.

1/10 oz Gold Krugerrand

The perfect entry-point. This 22K fractional coin is ideal for diversifying your holdings with smaller, highly tradable units.

1 oz Gold Buffalo (Proof)

For the discerning investor. A stunning, proof-quality coin minted in pure 24K gold. A collector’s piece and a solid asset.

1/10 oz Gold Maple Leaf

Maximum purity in a fractional size. This .9999 fine gold coin is one of the most trusted and recognized bullion products globally.

Red Flags: The Scams That Will Rob You Blind

They lure you in with ads for popular bullion coins, then a high-pressure salesman tells you the “real money” is in “rare” collectibles with massive, hidden markups. If you can’t check its value against the spot price, it’s a trap. Stick to bullion.

This is common with shady Gold IRA companies. They sell you coins for your IRA, then tell you it’s legal to store them at home, which it isn’t. This can trigger massive IRS penalties, and they know it. Your IRA metals must be in a third-party depository.

Anyone can build a website. A real dealer is a member of industry groups like the ANA (American Numismatic Association) or PNG (Professional Numismatists Guild). No credentials? No deal. It’s that simple.

Your Personalized Allocation Blueprint

Don’t Take Our Word For It. See The Results.

“I was about to get fleeced on some ‘rare’ coins. The Scam Watch section saved me over $8,000. This site is a public service.”

– Mark S.

“Finally, a site that isn’t trying to sell me something on every line. I used the Gold Investment Guide and made my first purchase with 100% confidence. No BS, just value.”

– Jenna R.

The Five Questions You Should Be Asking Before You Buy Gold Coins

The safest way is through a highly reputable, established dealer with a long track record, transparent pricing, and memberships in bodies like the ANA or PNG. Never buy from unsolicited calls, social media ads, or high-pressure salespeople.

For 99% of investors, the best type is a common, government-minted bullion coin like the American Eagle or Canadian Maple Leaf. Their value is tied directly to the gold spot price, they are highly liquid, and have low premiums compared to “rare” numismatic coins.

You should pay the current gold spot price plus a small premium, which covers minting and dealer costs. For a 1 oz bullion coin, a competitive premium is typically 3% to 6%. If a dealer is charging significantly more, you are overpaying.

While some banks outside the U.S. do, most banks in the United States do not sell gold coins directly to the public. You will need to go through a private mint or a reputable precious metals dealer.

Investors buy gold not to “time the market,” but because it’s a long-term store of value and a hedge against economic instability. The best time to buy insurance is before you need it. The same logic applies to gold.

The Work Is Done. It’s Time To Act.

You have the knowledge. You have the blueprint. The only thing separating you from a more secure financial future is a single decision. Browse our vetted recommendations and take the first step.

Build Your AssetAffiliate Disclaimer: We believe in transparency. This site contains affiliate links. If you use these links to make a purchase, we may earn a commission. This costs you nothing extra and allows us to keep providing this high-value intelligence for free.

Financial Disclaimer: We are not financial advisors and this is not financial advice. The content here is for educational purposes only. Investing has risks. Do your own research and consult with a qualified professional before making any financial decisions.