A gold bar’s weight can change a lot. It depends on why you need the gold bar.

Gold Bar Weight at a Glance

- You will learn about different gold bar sizes.

- You will see how gold bar weights are measured.

- You will find out what affects a gold bar’s weight.

Estimated reading time: 4 minutes

Ever wonder about those shiny gold bars? Knowing how much does a bar of gold weigh is very important. This knowledge helps if you want to invest in gold. It helps you understand the value of what you are buying or selling.

What Kinds of Gold Bars Are There?

Gold bars come in many types. Each type has a common weight.

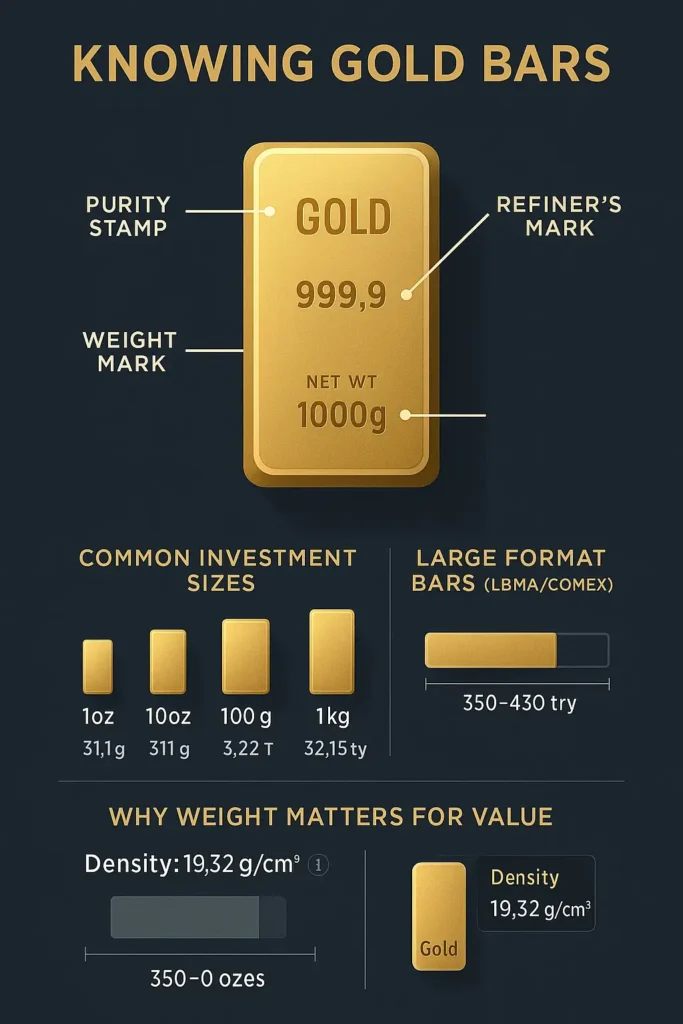

Standard Gold Bars Big banks and official groups often use these. The London Bullion Market Association (LBMA) has a type called “Good Delivery” bars. These bars are large. They usually weigh between 350 to 430 troy ounces. That is about 10.9 to 13.4 kilograms.

A very common size is around 400 troy ounces. These bars must be very pure, at least 99.5% gold. One source states their dimensions are often 7 inches x 3 and 5/8 inches x 1 and 3/4 inches.

COMEX Gold Bars These bars are used for trading gold in North America. They are often called COMEX Good Delivery bars. These bars usually weigh between 95 to 105 troy ounces.

The most common size is 100 troy ounces. They need to be 99.99% pure. You can learn more about these standards from COMEX directly.

Investment Gold Bars If you want to buy gold, you might look at smaller bars. These are easier for people to buy and store.

Buy Gold Online: The Smart and Secure Way

Discover the safest and most reliable strategies to buy gold online. Make informed investment decisions and secure your financial future today!

Learn More- 1 Ounce Gold Bars: These weigh exactly 1 troy ounce. That is 31.1034768 grams. They are at least 99.5% pure gold.

- 10 Ounce Gold Bars: These weigh 10 troy ounces. That is 311.034768 grams. They also have at least 99.5% purity.

- Gram Gold Bars: You can also buy gold bars weighed in grams. Popular sizes include 250 gram and 500 gram bars. These also need to be at least 99.5% pure gold, as noted by gold sellers like GoldCore.

Knowing how to buy gold bars involves understanding these different types and weights.

- Check Purity: Look for bars with high gold content, like 99.5% (or .995) or more. This means more pure gold for your money.

- Know the Weight Unit: Make sure you know if the weight is in grams, troy ounces, or kilos. This helps you compare prices fairly.

- Buy from Trusted Sellers: Choose well-known dealers to avoid fakes. Look for good reviews and clear business practices.

How Do We Measure Gold Bar Weight?

Gold has special ways it is weighed.

- Troy Ounces: This is the main unit for precious metals like gold. One troy ounce is about 31.10 grams. It is not the same as a regular ounce (avoirdupois ounce), which is about 28.35 grams.

- Grams: Many countries use grams. This is common for smaller gold bars.

- Kilograms and Pounds: These units are used for very large amounts of gold. A kilogram is 1,000 grams.

Understanding these units is important when you look at how much does a gold bar weigh. You might also be interested in how much a 1 tola gold bar weighs, as tola is another unit used in some parts of the world.

Quickly see how gold bar weights compare in different units.

Gold Weight Converter

The logic used is standard conversion factors: 1 troy ounce = 31.1034768 grams, and 1 kilogram = 1000 grams.

Big and Special Gold Bars

Most gold bars are made for trade or investment. But some are very special. The world’s largest gold bar is huge! It weighs 250 kilograms. That is 551 pounds. It is about 18 inches long.

Gold is also very heavy for its size. It is dense. Gold’s density is about 19.32 grams for every cubic centimeter. This means a small piece of gold can weigh a lot. It is almost twice as dense as silver.

Taking Gold With You

If you travel with gold in the United States, there are usually no set limits on how much you can carry. However, if you bring gold into or out of the country, you must know the rules. You might need to declare it. You might also have to pay taxes.

GoldCore offers some insights on traveling with gold. It is always best to check official customs rules before you travel.

Why Knowing Gold Bar Weight Matters

So, how much does a gold bar weigh? It truly varies. Small bars are good if you are new to buying gold. Very large bars are used by big players in the gold market. Understanding the different weights and types helps you make smart choices.

It helps you if you want to invest in gold or just learn more about it. You can also check sites like Atkinsons Bullion for more news on gold weights. For more about general gold bar weights, see this helpful article.

Gold bars come in many weights. Small ones are good for new buyers. Big ones are for serious trading. Knowing this helps you choose wisely.

Your Questions About Gold Bar Weight Answered (Simply)

How heavy is a standard bank gold bar?

What is the most common gold bar weight to buy for investment?

How many grams are in a troy ounce of gold?

Can I buy a 1 kilogram gold bar?

What does LBMA ‘Good Delivery’ mean for gold bars?

How big is a 400 oz gold bar?

Are there rules for traveling with gold bars?